Wells Fargo Exits Commercial Mortgage Servicing as Trimont Takes the Lead

Wells Fargo Exits Commercial Mortgage Servicing

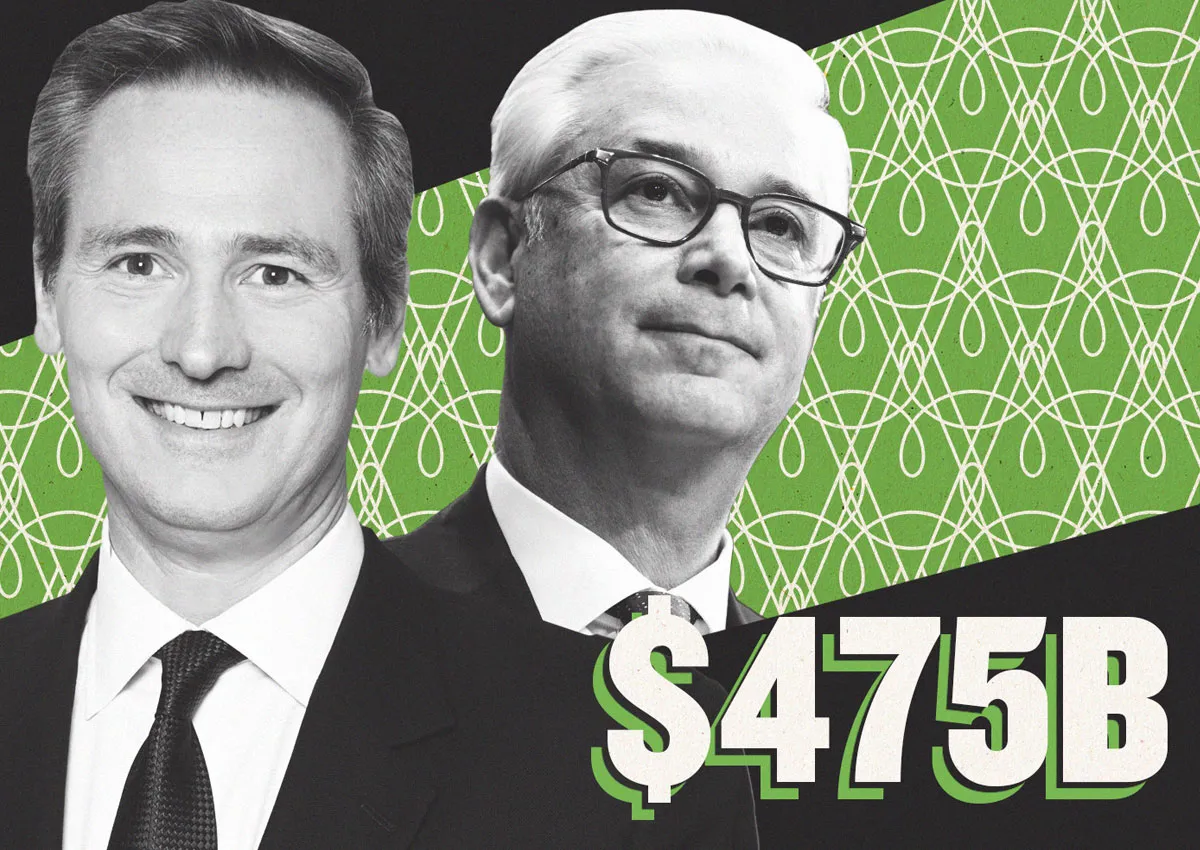

Wells Fargo has made the pivotal decision to sell off most of its commercial mortgage servicing operations to Atlanta's Trimont. This transaction elevates Trimont from a modest tenth position to a formidable first in the commercial mortgage servicing sector.

Details of the Transaction

- Trimont acquires Wells Fargo's non-agency third-party commercial mortgage servicing business.

- The deal encompasses approximately $475 billion in loans.

- Trimont's managed loans are set to rise to over $715 billion.

Strategic Shift for Wells Fargo

According to bank executive Kara McShane, this move aligns with Wells Fargo’s strategic focus on core businesses important to their consumer and corporate clients. Despite this sale, the bank plans to maintain servicing on its own balance sheet loans.

The Market Impact

This announcement did not drastically affect Wells Fargo’s stock price, which remains robust with a year-to-date increase exceeding 14 percent. As the loan servicing landscape transforms, nonbank entities are increasingly asserting themselves in a sector traditionally dominated by banks.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.