Rio Tinto's Iron Ore Glut: Implications for EBITDA in 2023

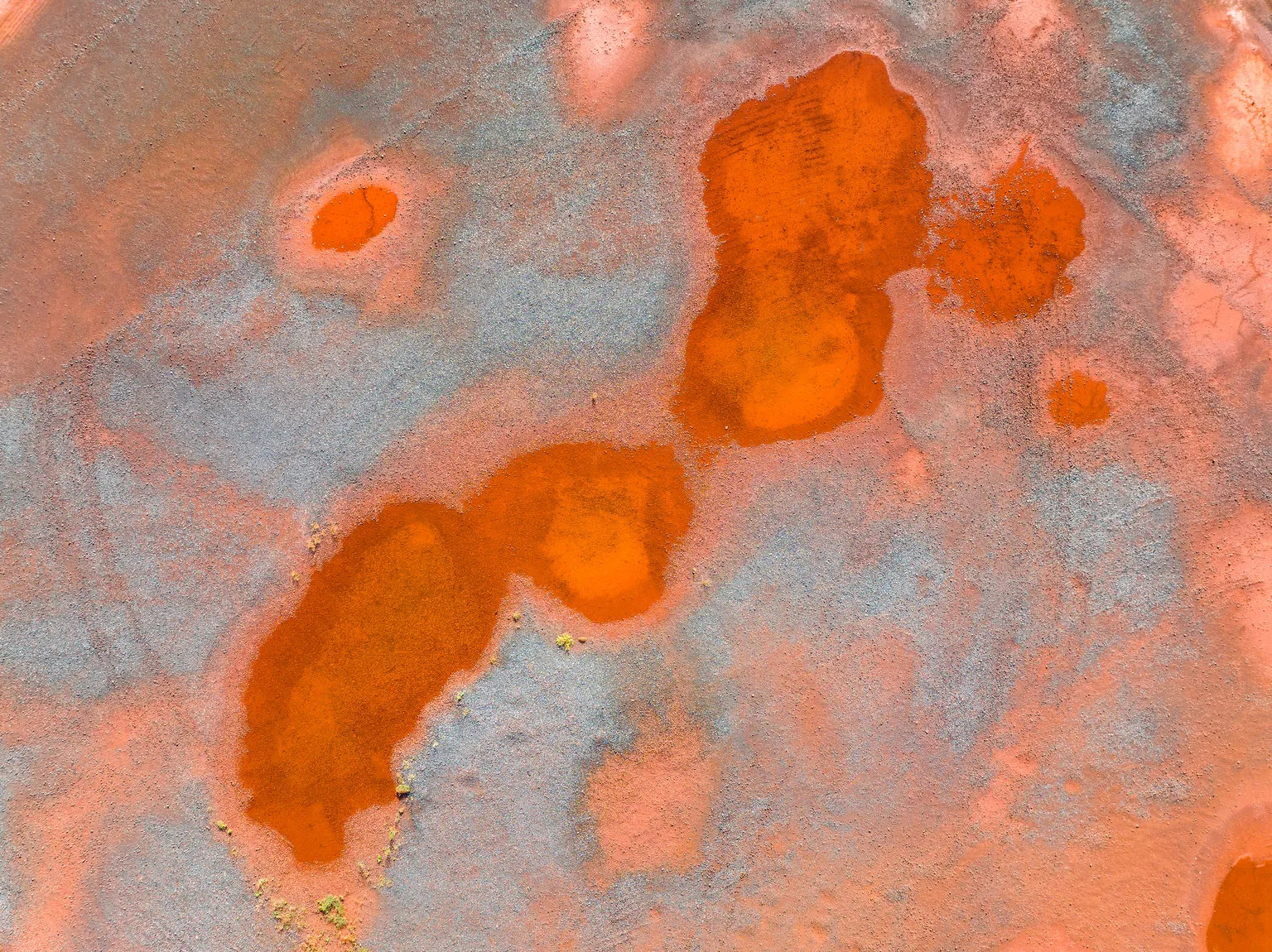

Rio Tinto Faces Iron Ore Glut

As Rio Tinto navigates its path through the iron ore sector, the upcoming glut looms large. By the year-end, expectations indicate a further expansion in supply, potentially cutting EBITDA by half.

China's Influence

Rio Tinto’s substantial exposure to Chinese demand amplifies the risks. With China's economy showing signs of slowing, the demand for iron ore may wane significantly.

- Potential EBITDA Impact: Analysts speculate significant compression of margins.

- Risk of Overproduction: Increased supply without corresponding demand could worsen the situation.

Outlook for Investors

Investors must approach RIO stock with caution as the bearish outlook highlights challenging conditions. Observing global economic indicators will be essential to assess any potential rebounds.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.