Estee Lauder (EL) Earnings Show Muted Outlook for FY2025

Q4 Performance Analysis

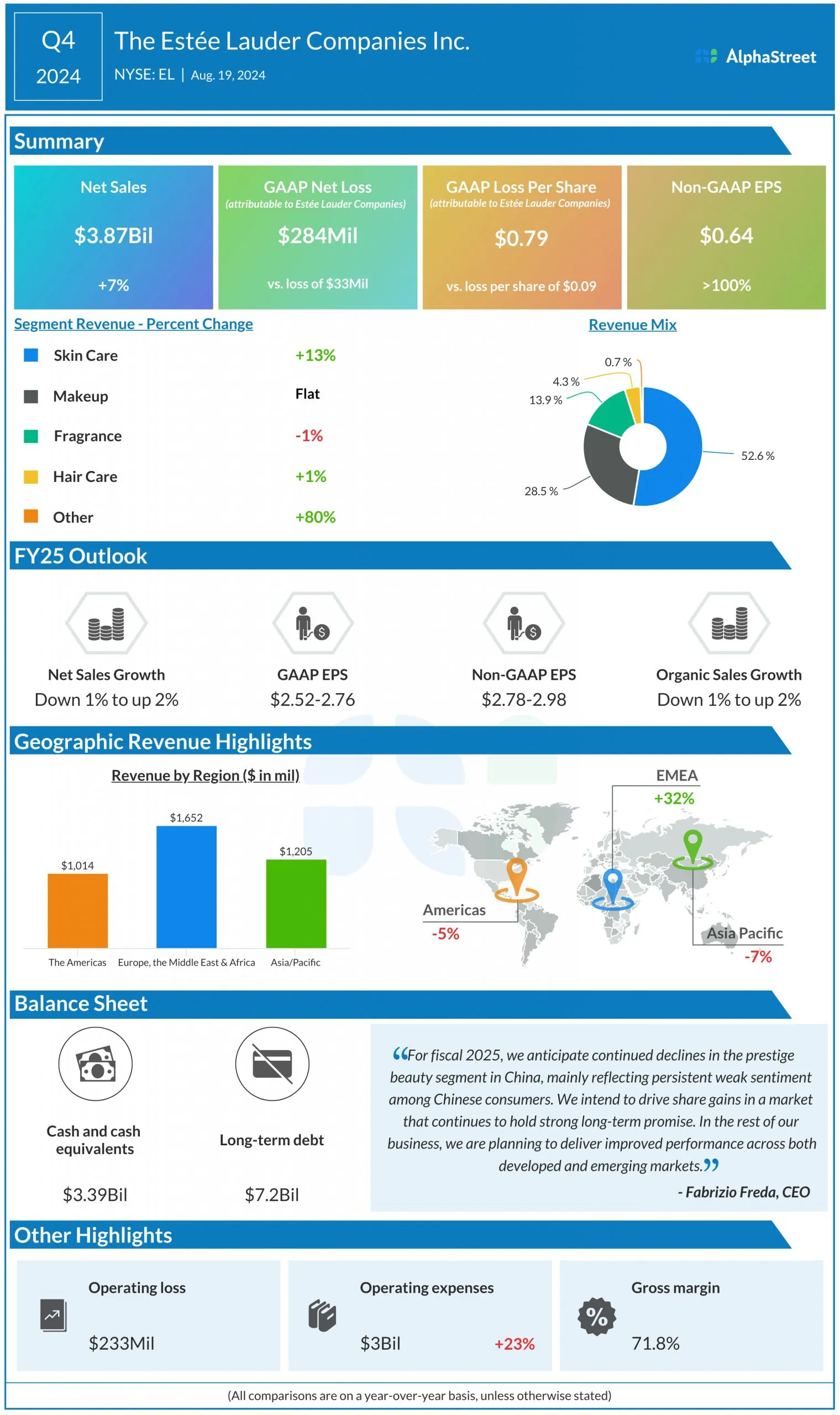

Estee Lauder’s (EL) Q4 2024 performance demonstrated resilience with net sales increasing by 7% year-over-year to $3.87 billion. This growth was supported by organic sales, which rose by 8%, attributable to strength across all product categories.

However, weakness in the mainland China and North America markets emerged as significant concerns. Inflationary pressures in North America and a cautious consumer sentiment in China are contributing factors to this trend.

Regional Performance Breakdown

- E.M.E.A Region: Experienced organic sales growth of 32%, driven by prosperity in Asia travel retail and priority emerging markets.

- Asia Pacific: Reported a 4% decline in organic sales, largely due to decreased prestige beauty demand in mainland China.

- Americas: Organic sales dropped by 5%, primarily from a competitive North American landscape.

FY2025 Outlook and Challenges

For FY2025, Estee Lauder forecasts that the global prestige beauty market will only grow by 2-3%. Weak consumer sentiment and competitive pressures particularly in mainland China and Asia travel retail are anticipated to adversely affect Estee Lauder’s performance.

Expectations for the first quarter of FY2025 include a 3-5% decrease in net sales year-over-year, alongside adjusted EPS ranging between $0.01-0.09.

Overall, Estee Lauder's results reflect significant challenges ahead, with sales for the year forecasted to show little change—projected to remain flat or see a modest decline.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.