Nvidia (NVDA) Q2 2025 Earnings Report: What Investors Should Know

Nvidia (NVDA) Q2 2025 Earnings Forecast

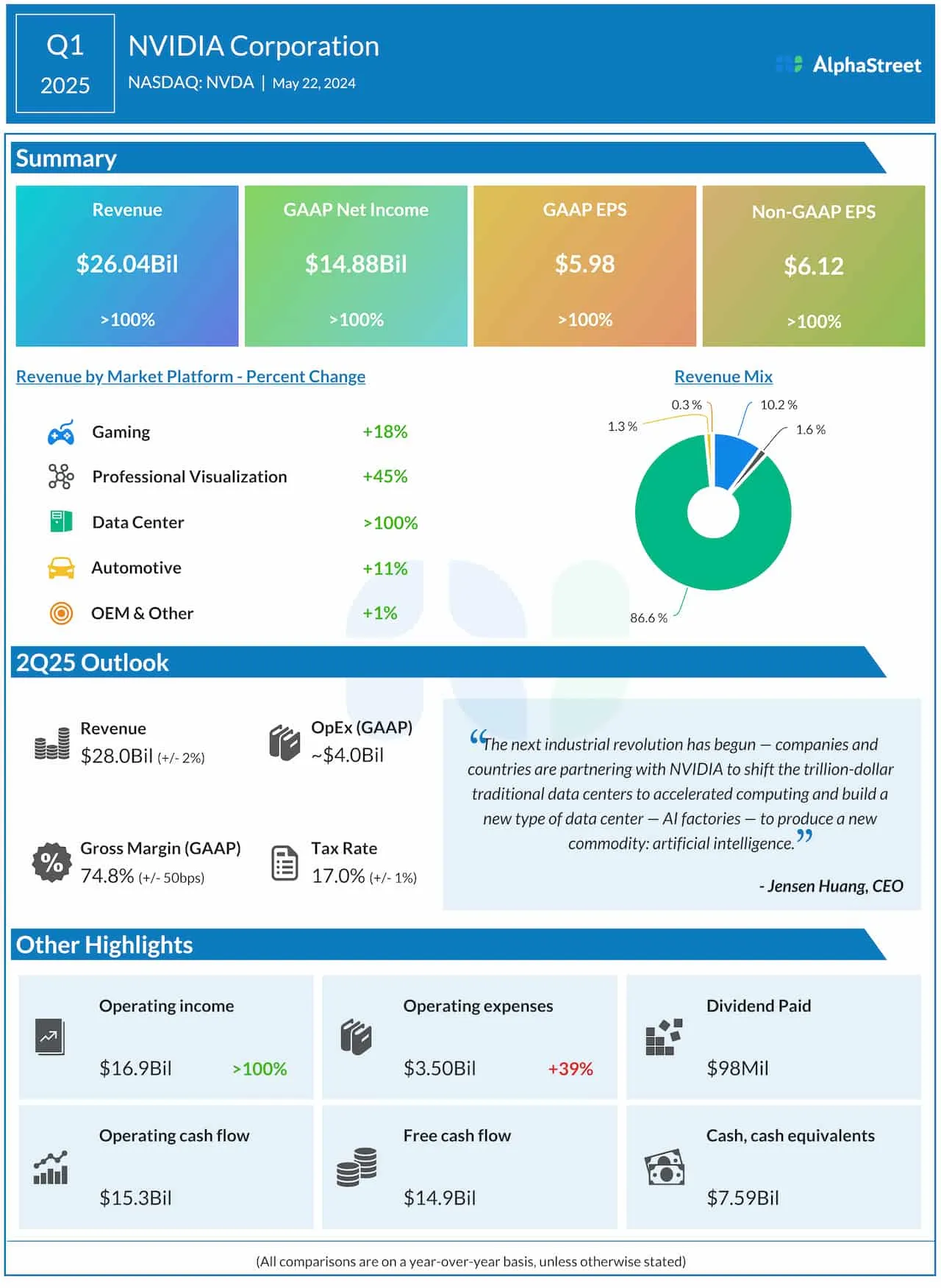

Nvidia (NASDAQ: NVDA) is preparing to report its second-quarter earnings for fiscal 2025 on August 28, 2023, at 4:20 PM ET, aiming for anticipated revenues of $28 billion. This projection, while slightly below analysts' estimates of $28.59 billion, marks a significant increase from the $13.5 billion reported in the same quarter last year. The consensus among experts points to earnings of $0.64 per share, up from $0.25 year-over-year.

Market Dynamics

The rise of artificial intelligence and the shift towards accelerated computing are driving Nvidia's success in the semiconductor industry. Tech giants are heavily investing in Nvidia's solutions, converting traditional data centers into AI-powered units. The company maintains a significant first-mover advantage, especially with the eagerly awaited Blackwell platform set to enhance performance and efficiency in data processing.

- Strong revenues driven by AI and gaming

- Dominance in the semiconductor sector post-pandemic

- Ongoing bullish sentiment among investors regarding Nvidia stock

Financial Performance Overview

Nvidia's revenue skyrocketed over the past quarters, achieving about $26 billion in Q1 2025, a reflection of robust growth across all divisions, particularly Data Centers and Gaming. Adjusted earnings per share soared to $6.12, with unadjusted profits exceeding 100% year-on-year.

In conclusion, as Nvidia approaches its earnings announcement, investors remain focused on the company's potential to continue leading in the AI and semiconductor markets. Securely positioned at an all-time high price around $130, up from an average of $76.56 over the last 12 months, NVDA is a compelling long-term investment consideration.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.