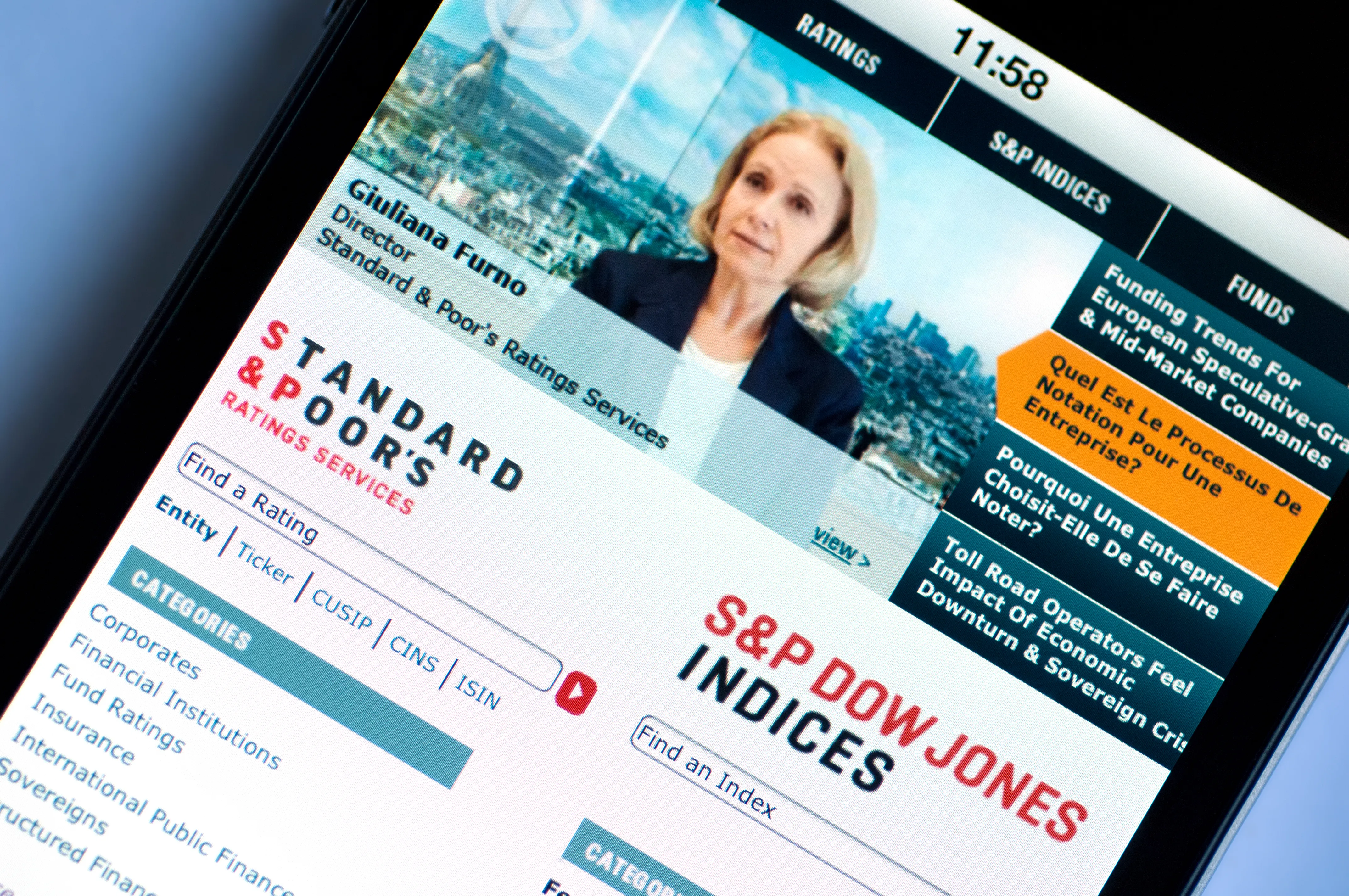

S&P Global Stock Analysis: High Returns, Share Buybacks, and Valuation Concerns

High Returns on Assets

S&P Global consistently reports high returns on assets, reflecting strong financial health. This performance is a key indicator for investors looking for reliable investments in today's market.

Share Buybacks as a Strategy

In addition to impressive asset returns, S&P Global engages in share buybacks, a move aimed at enhancing shareholder value. However, this strategy might be seen as a double-edged sword, especially given the current high valuation.

Valuation Metrics and Market Concerns

Nonetheless, despite the strong financial metrics, S&P Global stock appears very expensive. Potential investors should consider whether the high valuation justifies the financial performance before making an investment decision.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.