U.S. Elections Drive Nearly $350M in Bitcoin Options Open Interest

Electoral Influence on Bitcoin Options

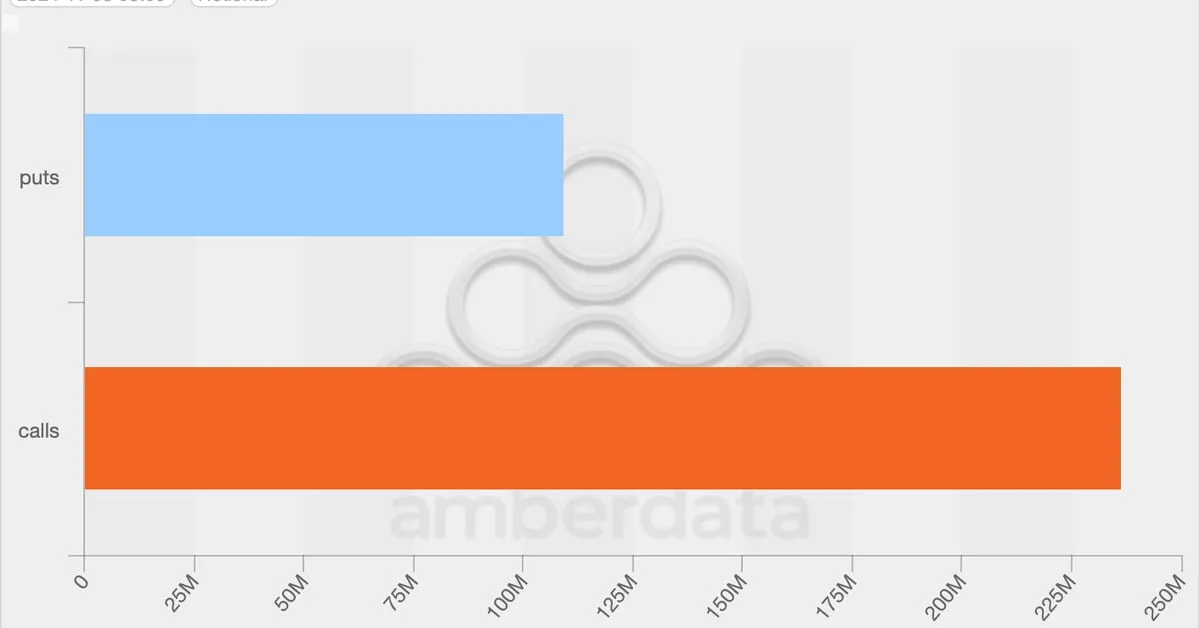

The recent surge in Bitcoin options is closely tied to the U.S. elections, with open interest reaching nearly $350 million. This development highlights the growing anticipation surrounding potential market movements as investors react to the political climate.

Market Sentiment and Analysis

Market sentiment is leaning towards a bullish outlook, with many foreseeing an increase in volatility as election day approaches. Experts believe that as uncertainties unfold, traders are positioning themselves to capitalize on any price fluctuations.

- Key Trends:

- Increase in open interest

- Bullish sentiment among traders

- Speculative strategies gaining traction

Implications for Cryptocurrency Investors

For cryptocurrency investors, this trend could present significant opportunities. As the election impact shapes the Bitcoin landscape, staying informed about market movements is crucial. Monitoring open interest trends could be pivotal for smart trading strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.