Intuit (INTU) Earnings Report: Focus on AI Integration and Financial Technology

AI Integration Highlighted as Intuit (INTU) Approaches Q4 2024 Earnings

Intuit Inc. (NASDAQ: INTU), renowned for its tax management applications such as TurboTax and Credit Karma, is gearing up for its fourth-quarter earnings report, scheduled for Thursday.

Currently, the company is focused on implementing its multi-year strategy aimed at enhancing customer experience via AI integration. This initiative aims to automate significant tasks to improve operational efficiency.

Stock Performance Overview

INTU’s stock performance has been characterized by significant fluctuations this year, yet it showed modest gains. The stock increased by over a third in the past twelve months and currently trades above the 12-month average of $599.51. Given consistent double-digit earnings growth, there's potential for further increases in share price.

Financial Outlook and Expectations

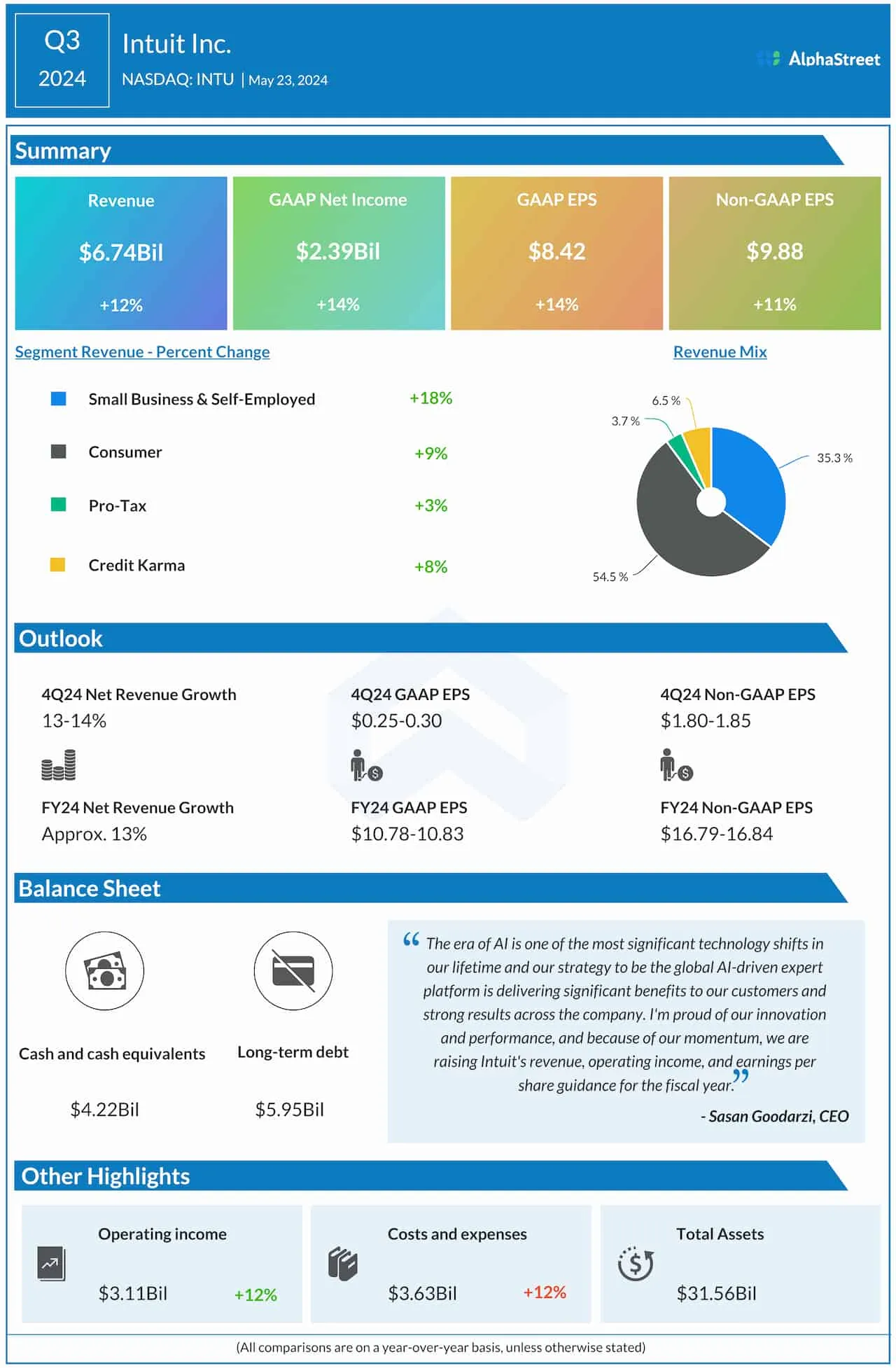

- Adjusted Profit Projections: Expecting $1.80 to $1.85 per share in Q4.

- Previous Year Comparison: $1.65 earnings per share reported last year.

- Revenue Growth Expectations: Anticipating a 13-14% growth rate in revenue.

Analysts forecast revenue to climb to $3.08 billion, reflecting a 13.6% year-over-year increase. Fiscal 2024 projections indicate adjusted net income between $16.79 and $16.84 per share.

Future Growth Prospects

Intuit's unique business model, underpinned by strong cash flow, facilitates reinvestment in innovation and shareholder returns. The strategic focus on AI tools positions Intuit for continued growth amid macroeconomic challenges.

Comments from Leadership

CEO Sasan Goodarzi highlighted the positive impacts of their digitization efforts, stating, "We’re seeing a lot of green shoots in both areas with total payments volume up 22%, showcasing our commitment to investment in this segment."

Q3 Performance Recap

The Small Business & Self-Employed segment, responsible for about 35% of total revenues, posted a 12% revenue increase year-over-year, amounting to $6.74 billion in the April quarter.

The adjusted profit also saw a boost of 11% year-over-year, reaching $9.88 per share, underscoring the firm’s strong performance across all divisions as it moves towards its earnings publication.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.