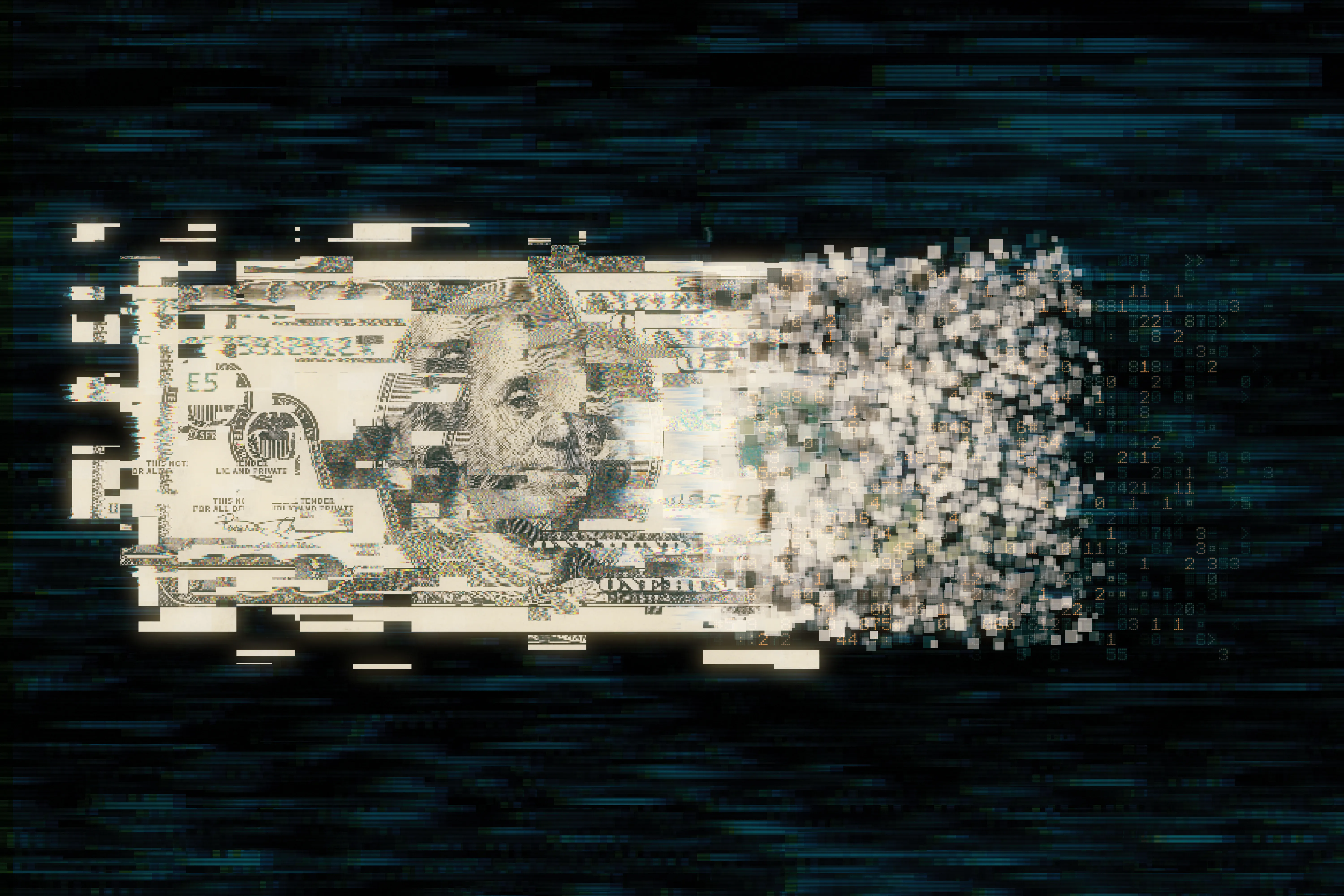

PayPal's Stock Surge Driven by Strong Financials and Strategic Initiatives

Understanding PayPal's Bullish Momentum

PayPal's recent stock performance demonstrates significant positive momentum driven by both technical indicators and strong fundamentals. A combination of growth strategies and robust financials highlights a promising path.

Financial Performance Insights

- Increased revenue streams

- Effective cost management strategies

- Innovation in digital payments

As these elements align, the stock's long-term target price stands at $90, while a moderate price forecast settles around $74.

Investment Strategies Moving Forward

- Monitor market trends impacting digital payments

- Assess technological advancements in the fintech space

- Stay updated on regulatory changes

These strategies are crucial for investors aiming to capitalize on PayPal's growth opportunity.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.