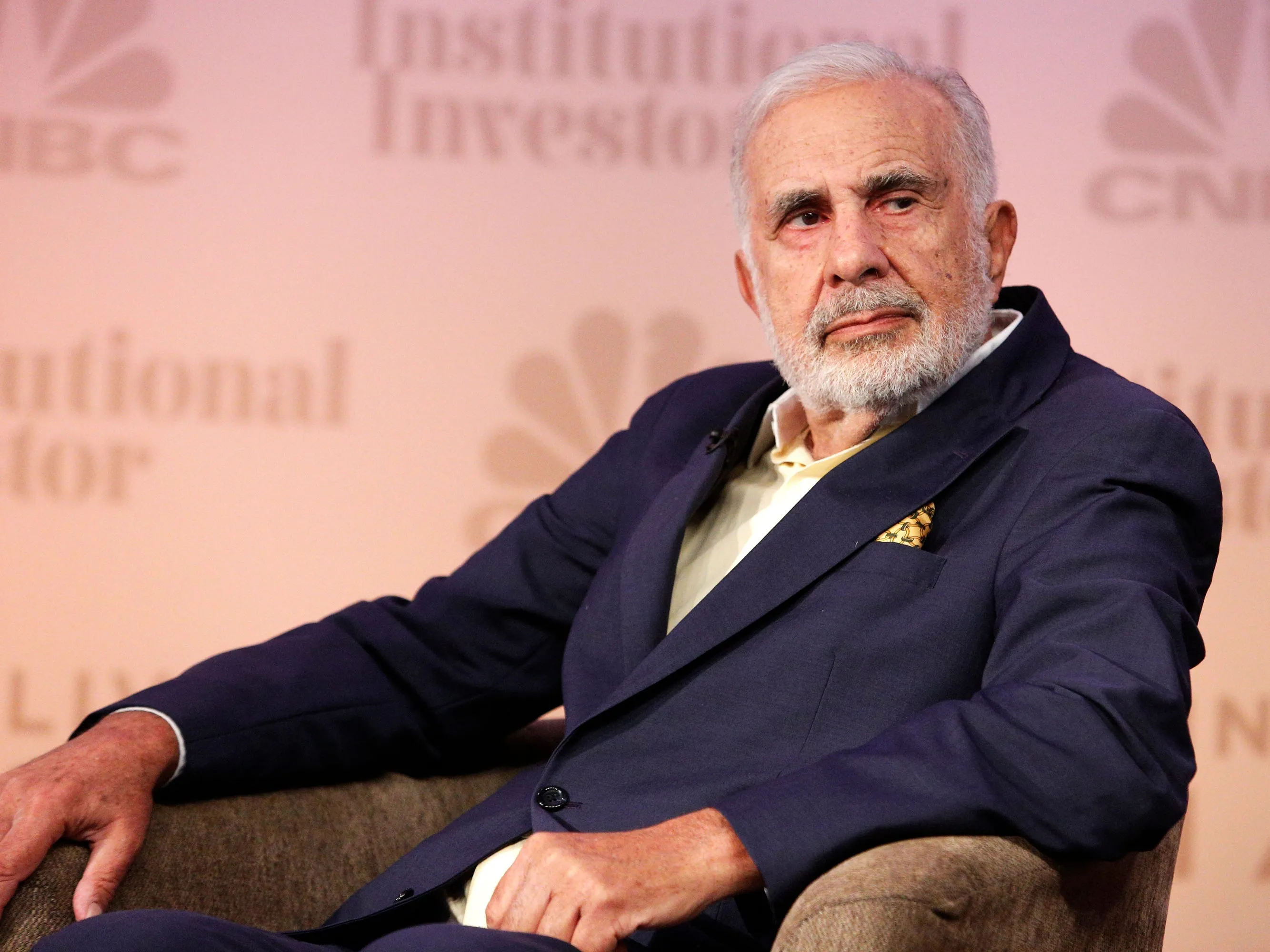

SEC Charges Carl Icahn Over Fraud in Stock Market Disclosures Regarding Icahn Enterprises

SEC Charges Carl Icahn Over Fraud in Stock Market

Billionaire investor Carl Icahn faces serious allegations from the Securities and Exchange Commission regarding his disclosures about his stake in Icahn Enterprises. The SEC claims Icahn neglected to fully disclose pledges made against his shares, settling charges with a hefty financial penalty.

Key Allegations Against Carl Icahn

- Icahn pledged between 51% to 82% of his outstanding shares as collateral.

- Failed to disclose significant borrowing in Form 10K.

- Neglected to amend Schedule 13D since at least 2005.

Impacts on Icahn Enterprises and the Stock Market

The SEC has noted that the disclosed margin borrowing survived until July 2023. Icahn’s total loans have ballooned to as much as $5.1 billion between 2018 and 2022—a startling revelation for stakeholders.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.