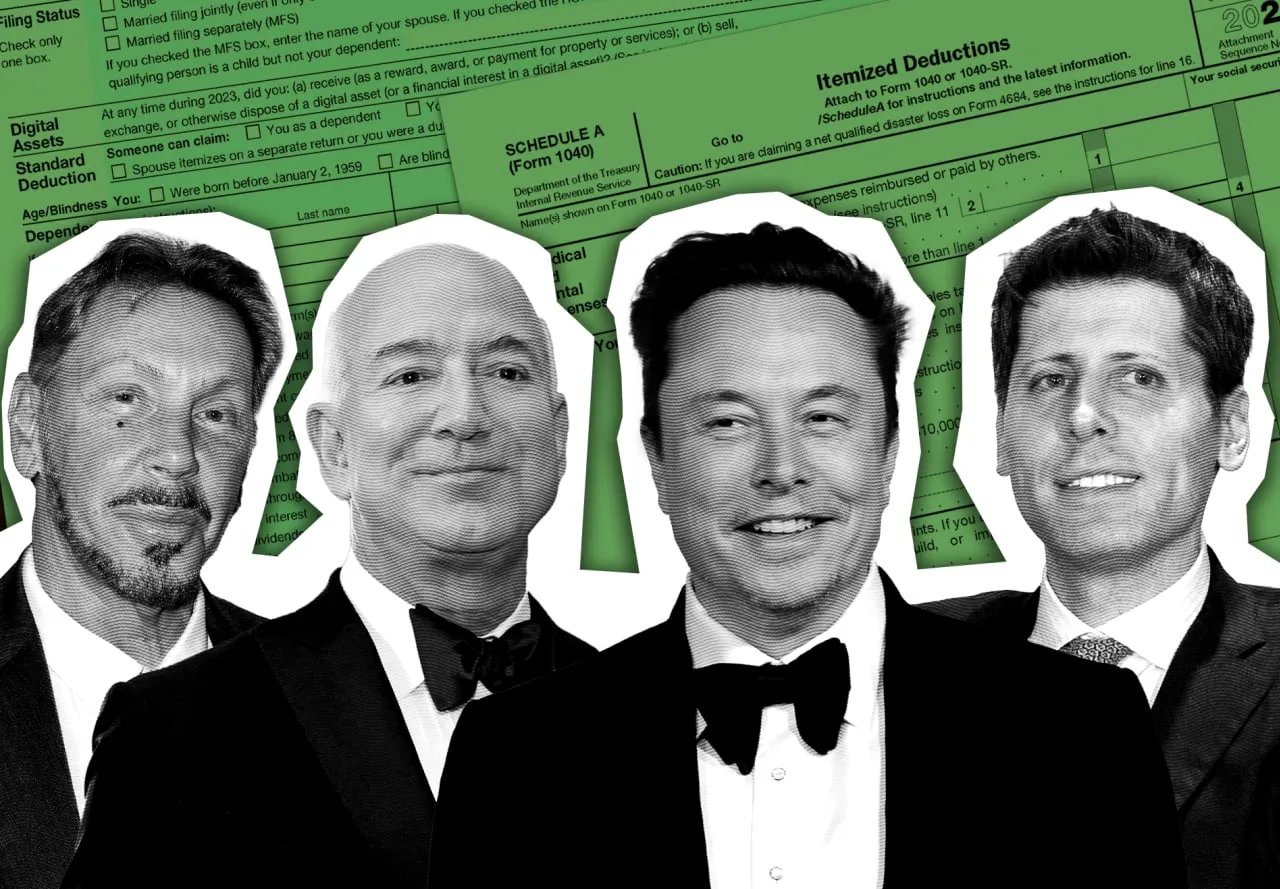

Taxing Billionaires: The Urgent Call for Reform

Why Taxing Billionaires Is Essential

The increasing wealth gap has made taxing billionaires a critical topic. High net worth individuals often benefit from loopholes that allow for lower tax contributions compared to the general population. A fair taxation policy would help address these disparities.

The Impact of Taxation on Society

Effective tax policies can create a significant impact on societal development. Taxation of the super-rich can lead to funding essential services and reducing national debt. Furthermore, it promotes a sense of equity amongst citizens.

- Addressing income inequality

- Funding public services

- Improving economic stability

Global Perspectives on Billionaire Taxation

In light of recent discussions at the G20, pressure is mounting on governments to reform tax policies affecting high net worth individuals. Various countries have begun exploring options to enhance taxation frameworks.

- Implementation of progressive tax rates

- Closing loopholes in tax regulations

- Promoting transparency and accountability

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.