ASML Holding: Driving Growth with More High Bandwidth Memory (HBM) Equals More Extreme Ultraviolet (EUV) Technology

The Rise of ASML Holding

ASML Holding's stock price has witnessed a significant 42% surge since July 2023, reflecting the market's confidence in the company's technological prowess.

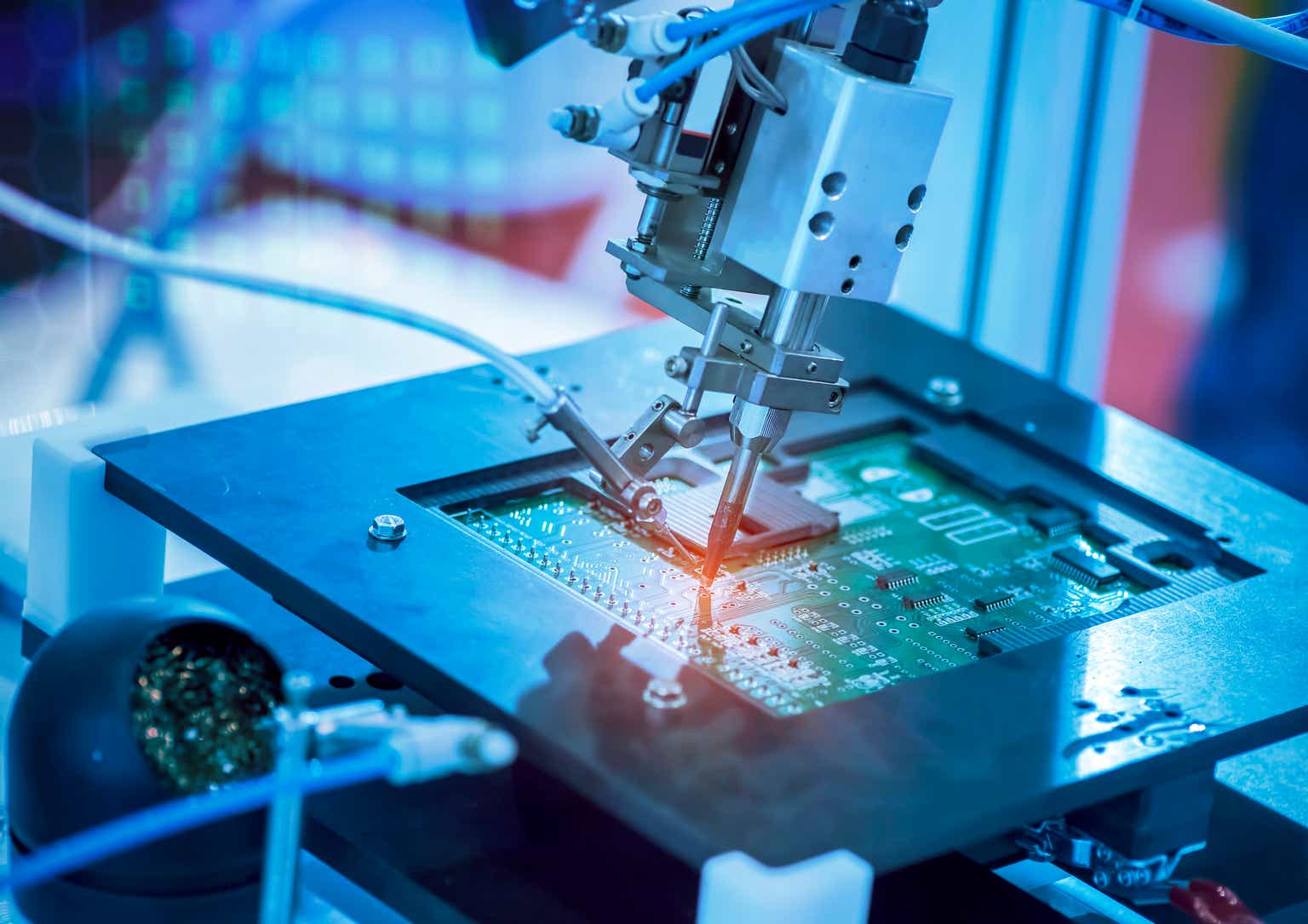

Monopoly in EUV Technology

ASML's dominant position in the Extreme Ultraviolet (EUV) technology sector has been a key driver behind its impressive stock performance.

Strategic Emphasis on HBM

The company's strategic focus on High Bandwidth Memory (HBM) has further enhanced its growth trajectory, solidifying its reputation as a strong buy in the market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.