The Implications of Roth IRAs and 401(k) for Retirement Planning

Understanding the Warning on Roth IRAs

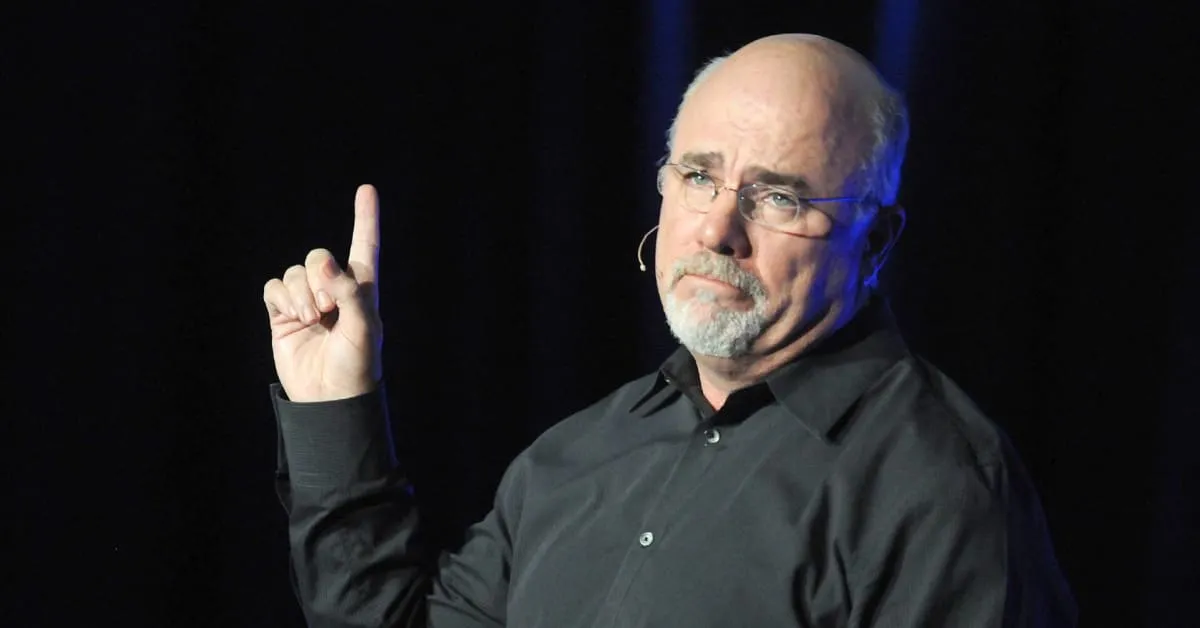

Financial Influencers like Dave Ramsey have voiced significant concerns regarding retirement savings strategies involving Roth IRAs. The essence of his message highlights the necessity to reassess one’s Investing habits, particularly when considering 401(k) plans.

Impacts on Social Security

Ramsey stresses that individuals should not count solely on Social Security benefits as a safety net for retirement. He promotes the idea of balancing investments in various retirement accounts to ensure a stable income stream.

- Consider long-term care insurance by age 60.

- Ramp up retirement savings early.

- Utilize savings vehicles like Health Savings Accounts (HSAs).

Effective Financial Planning Strategies

To thrive in today’s financial landscape, experts recommend proactively managing one’s assets through diversification. Using strategies that encompass both Roth IRAs and 401(k) plans can provide security against unpredictable market conditions.

For more detailed insights into Roth IRAs and effective retirement strategies, visit our website.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.