Strategies for Municipal Investors to Optimize Returns in Yield Curve Environment

Wednesday, 27 March 2024, 12:05

Optimizing Returns in a Challenging Environment

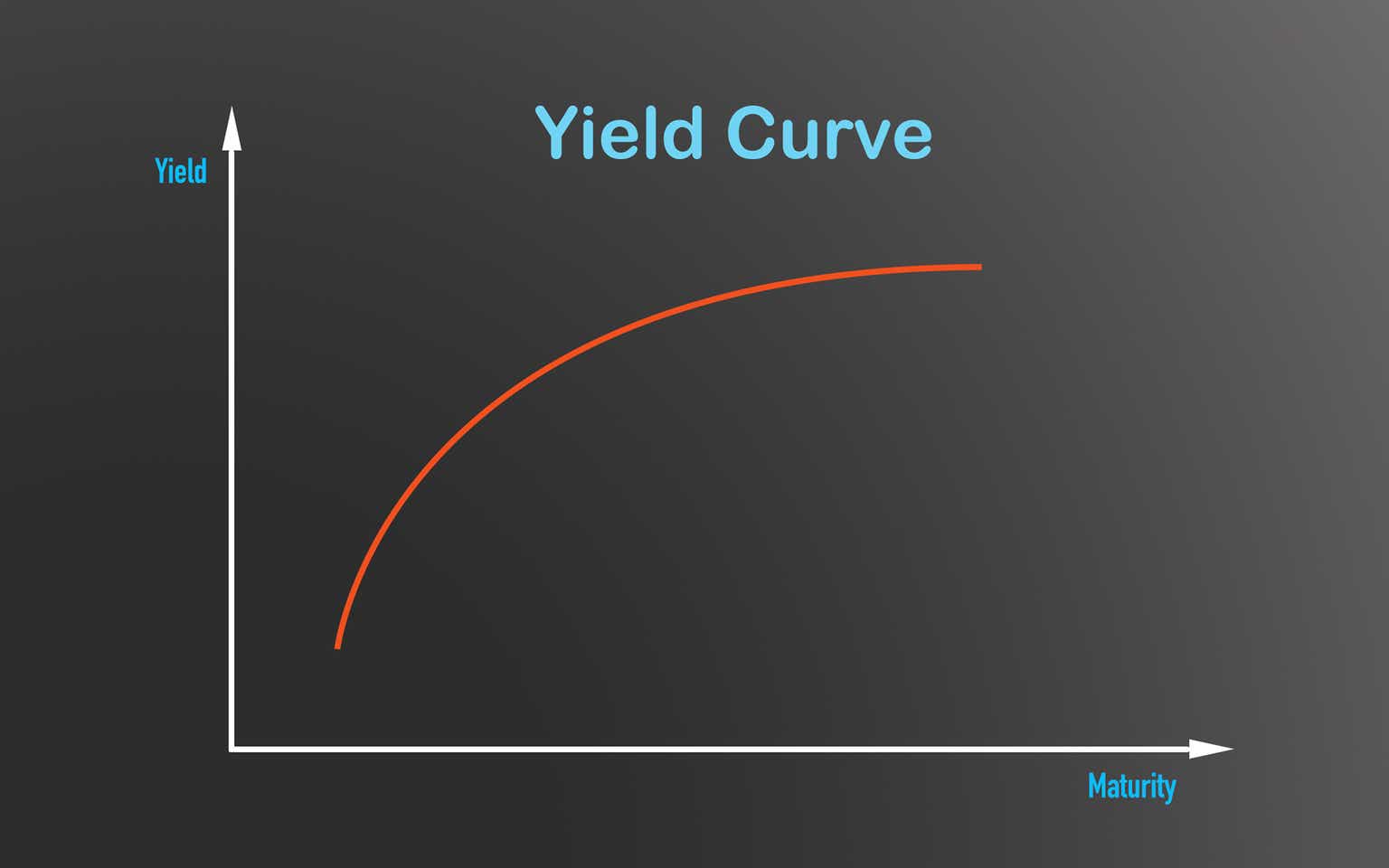

As the U.S. Treasury yield curve remains inverted, municipal investors can explore opportunities to enhance their investment portfolios.

Key Findings:

- Peak Yield Spread: June 2023 witnessed the highest point between 2-year and 10-year yields.

- Strategic Insights: Understanding yield curve dynamics is crucial for making informed investment decisions.

Overall, staying informed and adapting investment strategies can help muni investors navigate the current market conditions with confidence.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.