LUSIX's Push for Debt Settlement as Lab-Grown Diamond Prices Drop

LUSIX's Financial Strategy

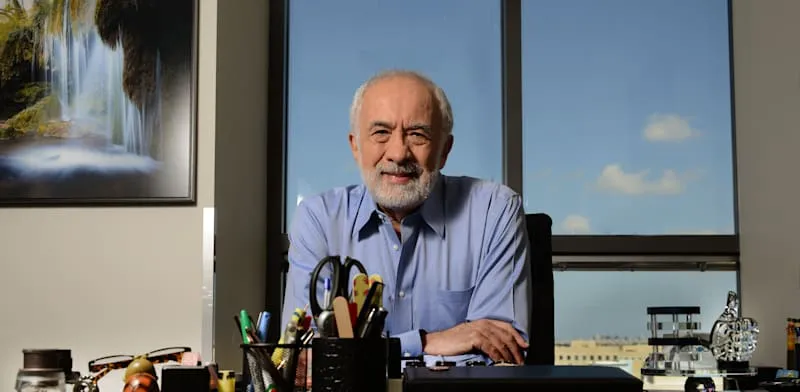

Benny Landa's LUSIX is pushing for a debt settlement with creditors to tackle the significant declines in lab-grown diamond prices, which have decreased by 90% on a global scale. The lab-grown diamond industry faces unprecedented challenges as consumer demand wanes, pressing companies like LUSIX to adopt strategic financial maneuvers.

Why Debt Settlement is Crucial

- LUSIX's ongoing struggle with severe market conditions has necessitated a reconsideration of financial obligations.

- The lab-grown diamond sector must adapt to minimize losses and ensure profitability.

- Benny Landa's leadership is pivotal in steering the company through financial turbulence.

Market Context

The precipitous decline in lab-grown diamond prices has widespread implications not just for LUSIX, but for the entire industry. As more companies experience a tightening market, proactive measures like LUSIX's may set the tone for future corporate strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.