Mortgage Rates Surge Again After Last Week's 16-Month Low

Mortgage Rates Bounce Back

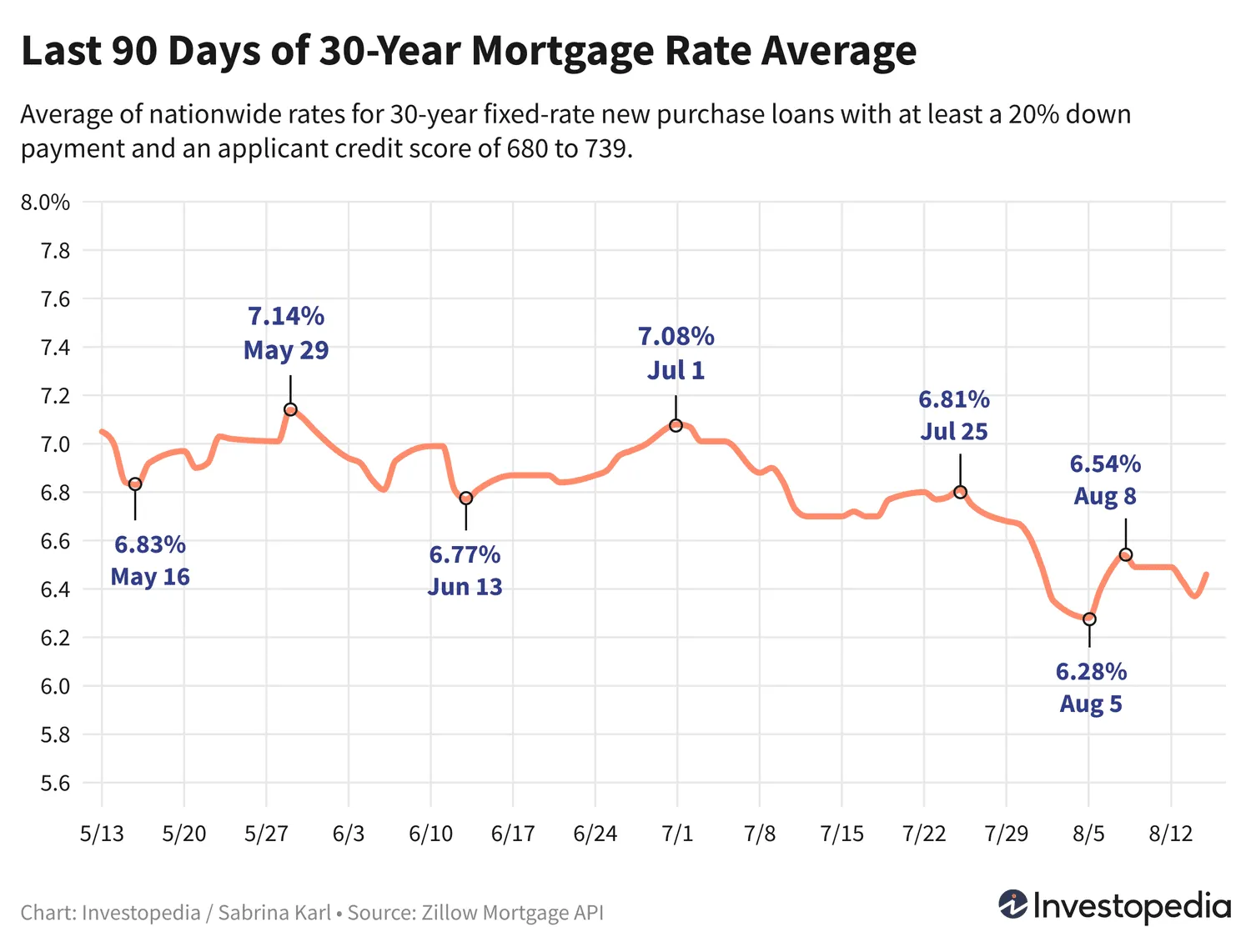

Mortgage rates moved higher, showing a significant shift after experiencing a 16-month low just last week. The latest data indicates that 30-year mortgage rates have increased, affecting affordability for many.

Factors Influencing Mortgage Rates

- Market Conditions: Economic stability plays a pivotal role in determining mortgage rates.

- Inflation Rates: Rising inflation can lead to higher mortgage costs as lenders adjust to increased risks.

- Federal Reserve Policies: Changes in monetary policy often influence long-term interest rates.

Impact on Homebuyers

The recent uptick in mortgage rates comes as a concern for homebuyers. Affordability has become a significant issue, and potential buyers must carefully evaluate their options. It's essential to stay informed about ongoing market shifts and their implications on personal financial planning.

Current Market Trends

As we analyze the implications of these changes, it's worth noting that even minor fluctuations in rates can significantly affect purchasing power. For those currently searching for homes, these trends could reshape buying strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.