Capital Southwest: Analyzing Stock Performance and Price Potential

Capital Southwest Stock Performance Overview

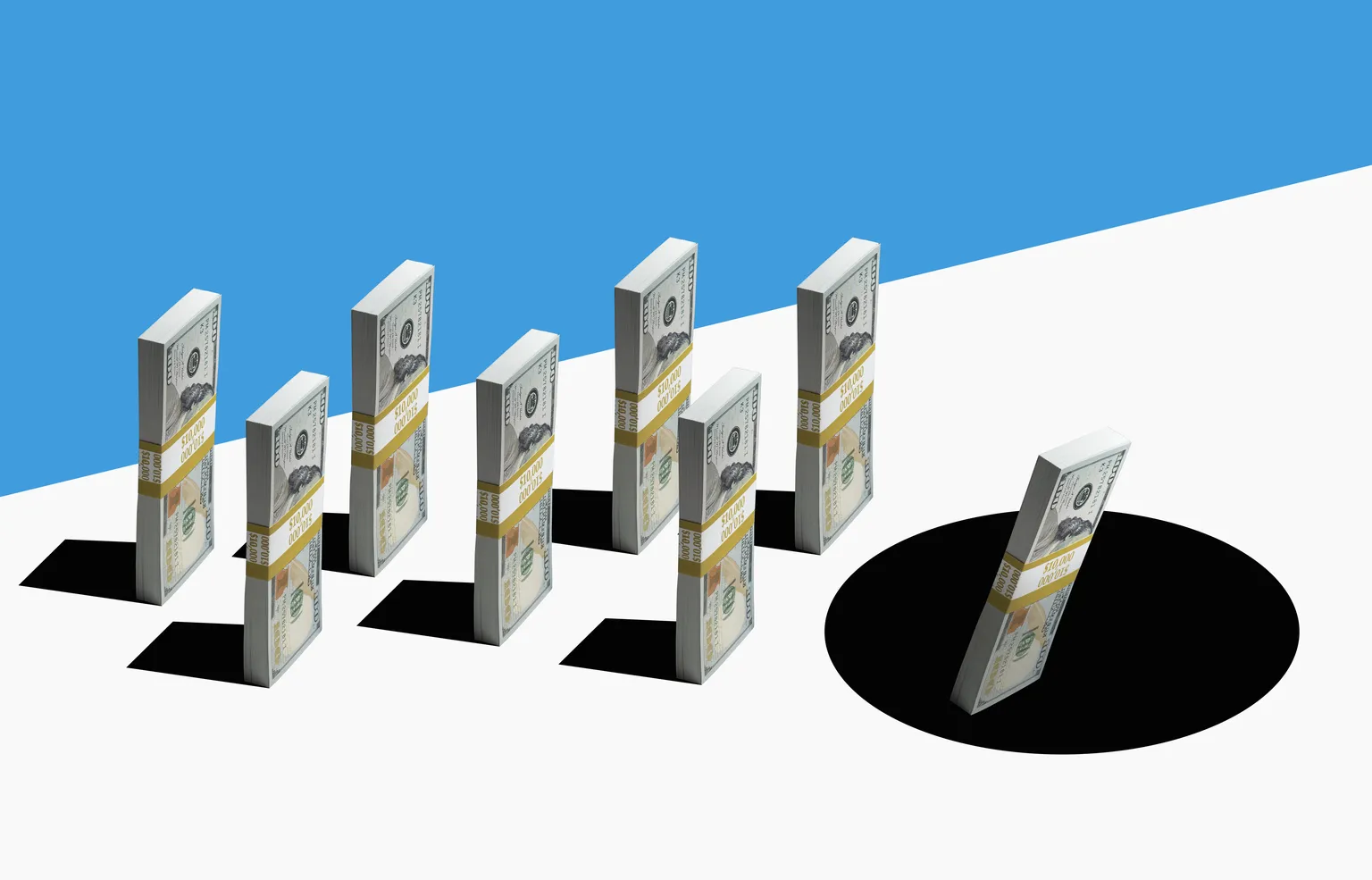

Capital Southwest (CSWC) has attracted investor interest due to its recent stock performance. The company has shown resilience, and its strategic initiatives hint at promising growth. However, a potential price drop is on the horizon, prompting some investors to hold off on purchases.

Dividend Coverage and Economic Resilience

The firm’s dividend coverage remains a strong point, which offers reassurance during economic downturns. As the market fluctuates, Capital Southwest's ability to maintain its dividend is a signal of its financial health.

- Strong historical dividend performance

- Increased earnings potential

- Pivotal growth strategies

Market Readiness for Economic Shifts

Analysts believe Capital Southwest's preparation for potential economic downturns will play a crucial role in its long-term stability. Evaluating CSWC amidst shifting market conditions can yield insights into its future trajectory.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.