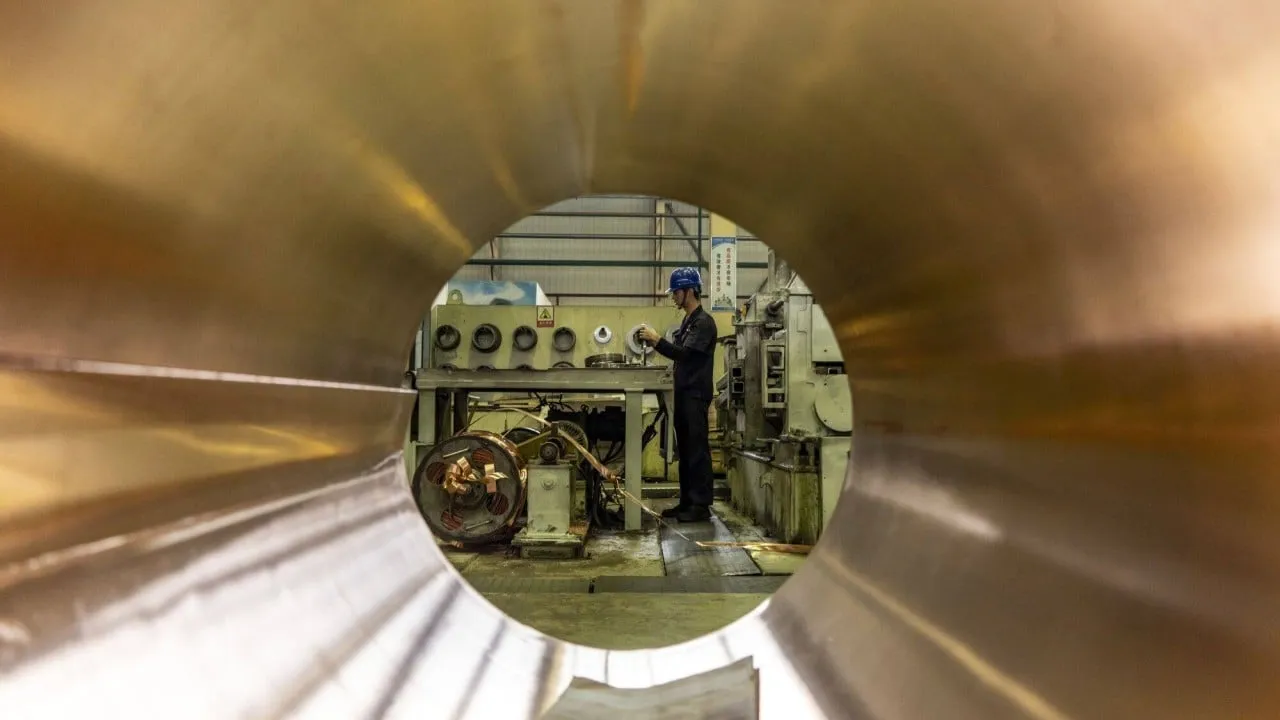

Impact of China's Copper Dominance on Global Mineral Supply Chains

Mineral Supply Chains at Risk Due to Chinese Competition

A global shift in mineral supply chains away from China’s copper manufacturing poses significant challenges and requires massive investments, according to Wood Mackenzie. This report notes that China controls 97% of global smelting and refining capacity, which translates to nearly 3 million tonnes of copper production.

The Financial Challenge of Decoupling

As noted, achieving decoupling from Chinese supply chains will necessitate an estimated US$85 billion investment in new plants. Wood Mackenzie indicates that these shifts could complicate manufacturing processes and drive up costs for end-products, disrupting both the appliance industry and the energy transition.

- China's significant investments in downstream processing present challenges for global copper supply security.

- Countries like Brazil and the United States are positioned to play a pivotal role in this context.

- India’s new smelter and Indonesia’s expansions reflect regional efforts to shift manufacturing away from China.

The Competitive Advantage of China

Despite the push for de-risking, experts emphasize that China maintains a competitive edge due to low operational costs and strict environmental standards. According to Liu Zhifei of Wood Mackenzie, China holds half of the global capacity to manufacture wire rods from copper, and that capacity continues to expand.

- Western leaders advocating for decoupling may risk diminishing supply chain efficiencies.

- Finance professor Zhao Xijun warns that removing China from the supply equation would complicate operations.

Ultimately, while political maneuvering may yield short-term gains, the long-term effects on industries relying heavily on copper could be detrimental.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.