Advance Auto Parts Q2 Earnings: Key Insights and Projections

Advance Auto Parts is gearing up to report its Q2 2024 earnings, which are likely to come in lower than last year. Market analysts predict earnings per share will dip to $0.97 from $1.44 a year earlier, while revenue is expected to hold steady around $2.67 billion. Challenges such as muted consumer spending and macroeconomic uncertainties mark this period for the company.

Institutional observers are keenly assessing AAP's turnaround strategies focused on operational efficiencies and potential margin improvements. Despite recent stock performance struggles, the company maintains a long-term growth stance, relying on aging vehicle trends to stabilize demand.

Current Financial Landscape

Advance Auto Parts' stock has seen a significant decline over the past 16 months, prompting a reassessment of its market strategies. With the overall performance forecasted to improve gradually in fiscal 2024, management highlights their structured approach to overcoming current challenges.

Operational Goals Going Forward

- Cost Reduction: Cutting costs to enhance competitive positioning.

- Asset Productivity: Focused strategies on utilization of company assets.

- Supply Chain Consolidation: Streamlining to elevate efficiency.

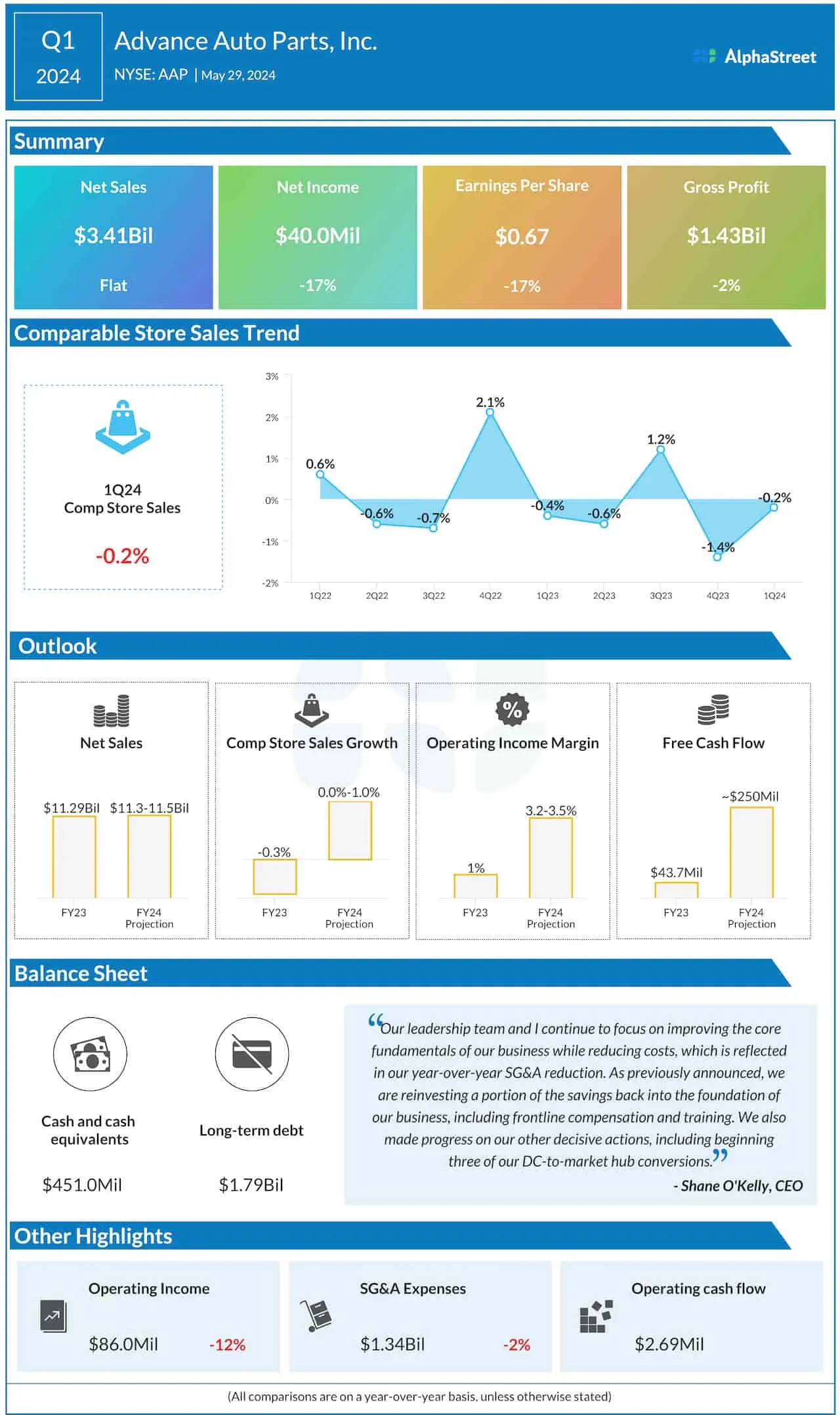

Fiscal challenges have impacted the early part of 2024, resulting in a 17% drop in net income for Q1. However, through decisive actions, AAP aims for a turnaround that will ultimately position it for a better operational landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.