Deere & Company Reports Decline in Q3 2024 Earnings

Deere & Company Q3 2024 Earnings Overview

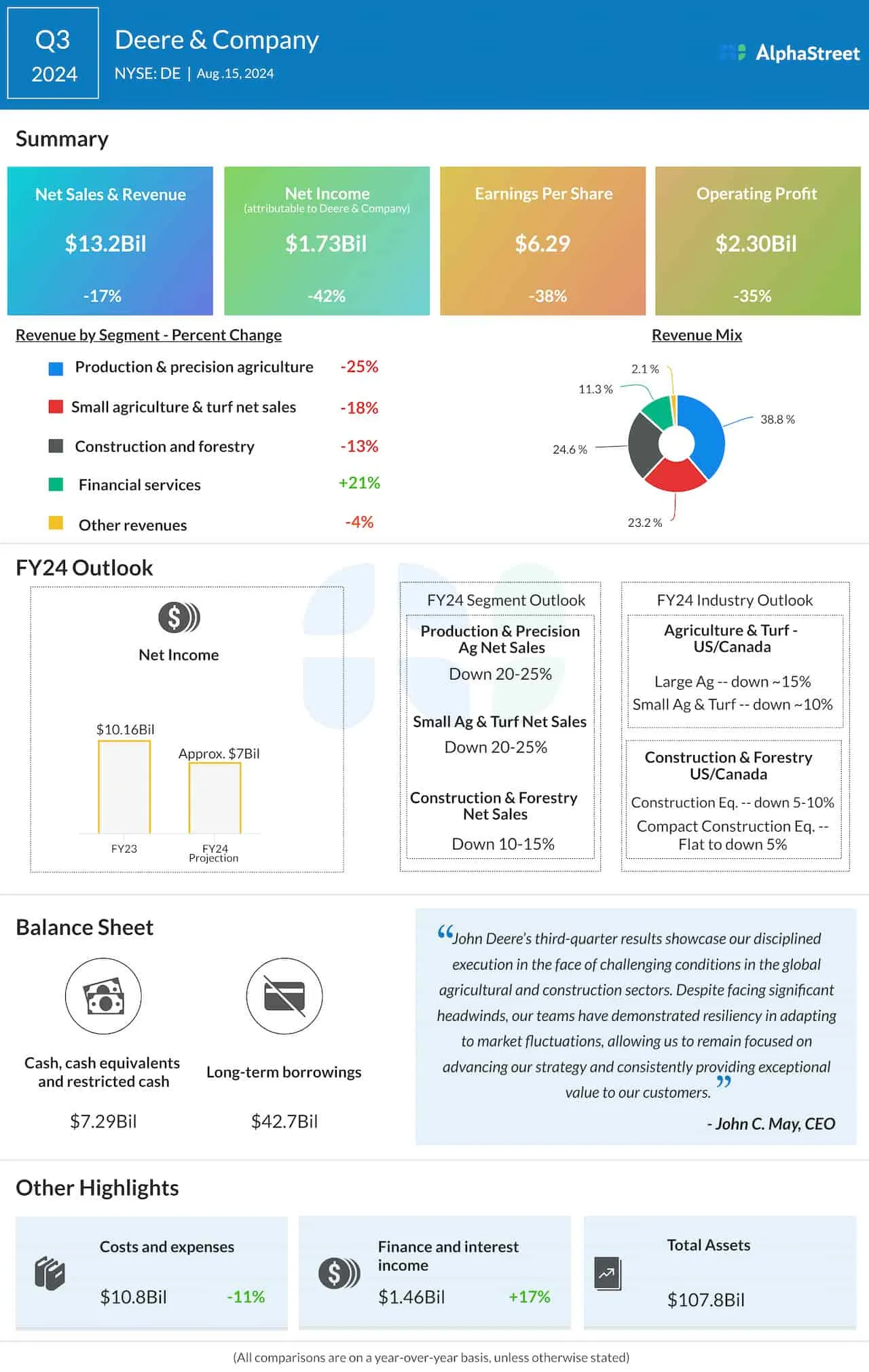

Deere & Company (NYSE: DE), a prominent player in the agricultural and construction equipment sectors, has reported a steep drop in its revenue and profit for the third quarter of 2024.

Key Financial Results

- Total net sales fell by 17% year-over-year to $13.2 billion in the July quarter.

- All operating segments experienced revenue declines, with the exception of Financial Services.

- Net income was reported at $1.73 billion, or $6.29 per share, compared to $2.98 billion or $10.20 per share a year earlier.

CEO's Remarks

CEO John May noted that despite the unfavorable conditions in global agriculture and construction, the company's execution remained disciplined.

Future Projections

For the fiscal year 2024, the net income attributable to Deere & Company is projected to reach approximately $7 billion.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.