Druckenmiller's Strategic Move: Decreasing Exposure to 'Magnificent Seven'

Overview of Druckenmiller's Holdings

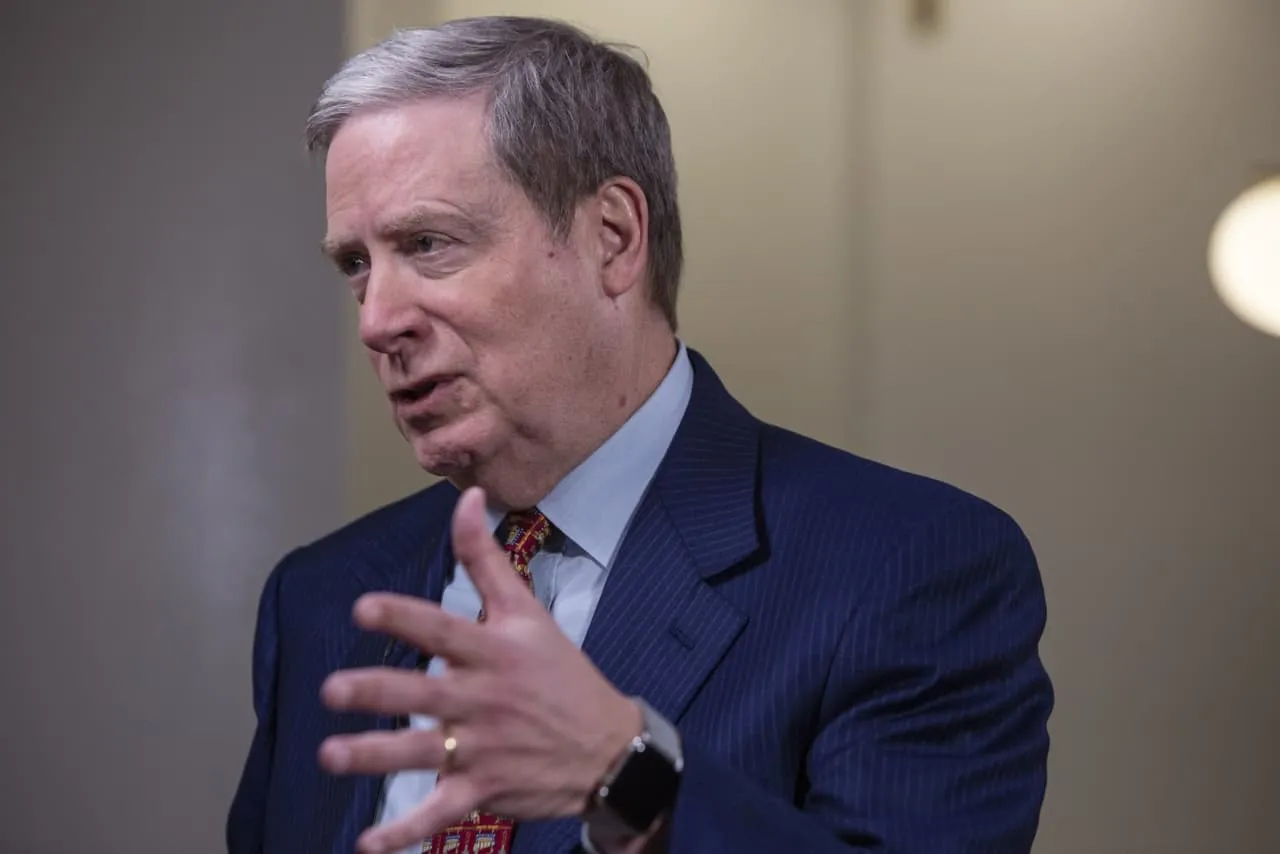

The recent 13-F filing from Stanley Druckenmiller’s Duquesne Family Office has brought to light significant changes in his investment strategy, particularly concerning the “Magnificent Seven” stocks.

Key Adjustments

- Trimming Positions: Druckenmiller has reduced his exposure to multiple stocks within the group.

- Strategic Reallocation: This indicates a shifting perspective on market dynamics.

Conclusion

Understanding the rationale behind Druckenmiller's moves provides valuable insights for investors. This cautious approach may reflect broader trends influencing the stock market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.