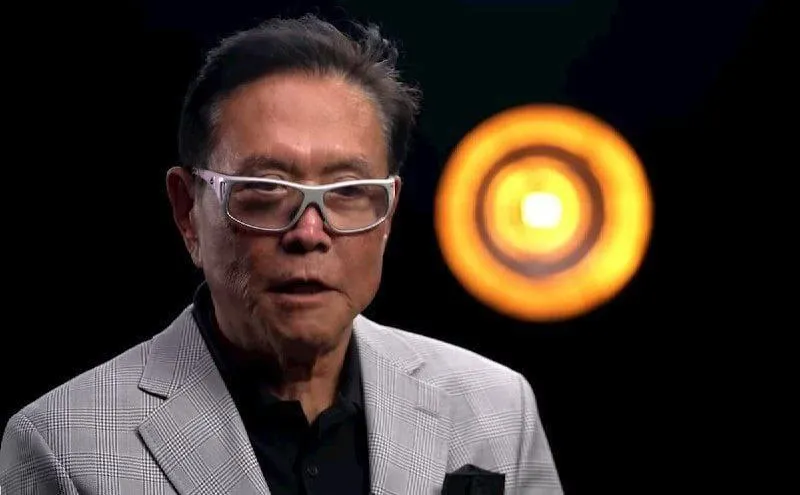

Robert Kiyosaki Predicts 'Biggest Market Crash in World History'

Warning of a Major Financial Downturn

Robert Kiyosaki, renowned entrepreneur and author of 'Rich Dad Poor Dad', has sounded the alarm on what he calls the 'biggest market crash in world history.' In a recent social media post, Kiyosaki expressed his concerns over the current U.S. economic leadership, which he derogatorily refers to as the '3-Stooges.'

Preparedness for Economic Turmoil

Kiyosaki believes that a significant market correction could lead to a depression, but he asserts that being prepared can offer substantial wealth opportunities. He emphasizes that 'crashing can be a good thing' for those who are ready to seize the moment.

Assets for Protection

To safeguard against what Kiyosaki describes as 'criminal policies' of U.S. financial institutions, he recommends investing in gold, silver, and cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). He labels those investing in these assets as 'rebels.'

Market Advice and Conclusion

As Kiyosaki reiterates his cautionary approach, he advises potential investors to conduct thorough research and remain aware of market dynamics. He foresees a path for Bitcoin to overcome its challenges and possibly reach a price target of $170,000 by early 2025. As always, individuals should be cautious and informed when making significant investment decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.