Analyzing Apple Stock (NASDAQ:AAPL): Positive Trends and Red Flag

Apple's Fiscal Q3 Earnings Report

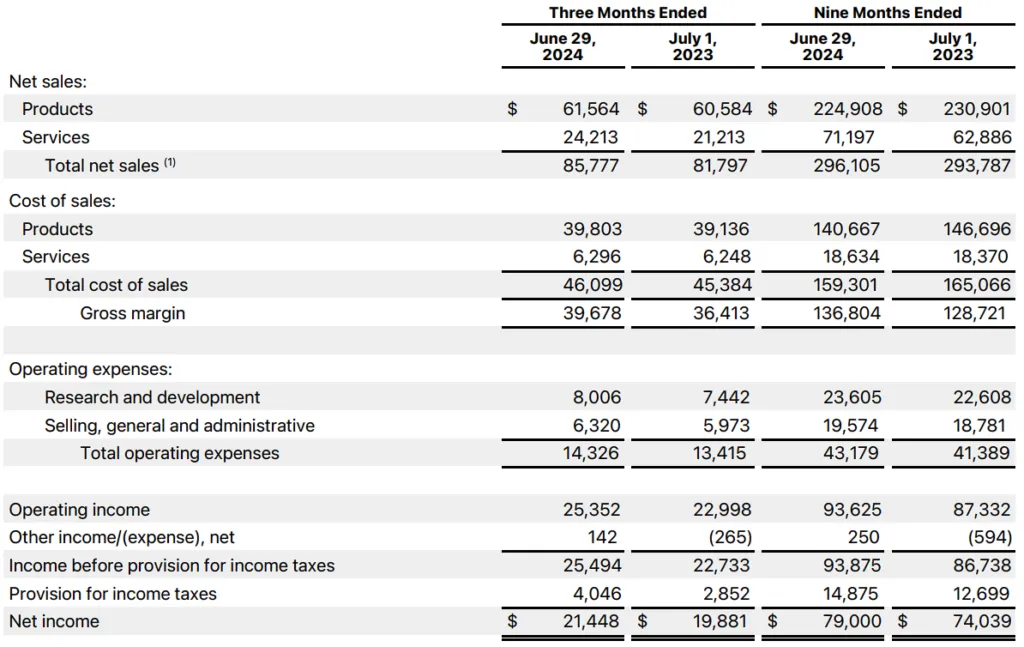

Apple (AAPL) has recently posted its Fiscal Q3 earnings, which reveal a series of bullish indicators along with a notable concern. Below, we outline the key points from the report.

5 Bullish Signs for Apple Stock

- Increased Revenue: The company reported higher revenue compared to previous quarters.

- Strong Product Demand: Apple's flagship products continue to see robust sales.

- Expanding Services Segment: Growth in its services division shows diversification benefits.

- International Market Performance: Successful expansion strategies in international markets.

- Positive Future Guidance: Management's optimistic outlook enhances investor confidence.

1 Red Flag to Consider

Despite these promising indicators, there is one red flag that could negatively influence the investment case for AAPL:

- Market Saturation: Concerns regarding market saturation in key product lines could hamper growth.

In conclusion, although the bullish signs from Apple's earnings report suggest a strong growth trajectory, the aforementioned concern requires careful consideration. Investors may want to adopt a neutral stance on AAPL stock at this time.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.