Diverging Signals: Understanding the Disconnect Between Stock and Credit Markets

Tuesday, 13 August 2024, 09:04

Diverging Market Signals

Recent analysis from Saba's Weinstein and TCW indicates that the stock and bond markets are currently sending conflicting messages about the likelihood of a U.S. recession.

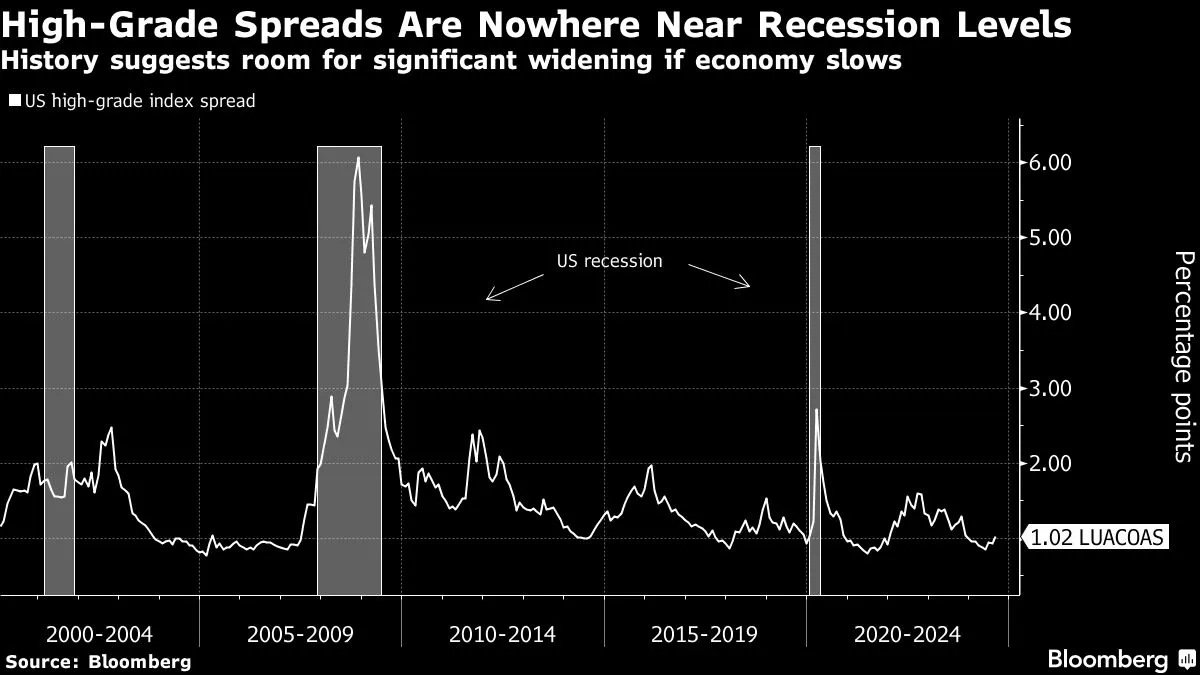

Complacency in Credit Markets

- Many major investors are warning that there is too much complacency in credit markets.

- This outlook contrasts with the more cautious tone reflected in the stock market.

Key Market Considerations

- Investors are advised to monitor market signals closely.

- The divergence raises concerns about economic growth sustainability.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.