China Implements Stricter Regulations in the Bond Market

Overview of China's Bond Market Actions

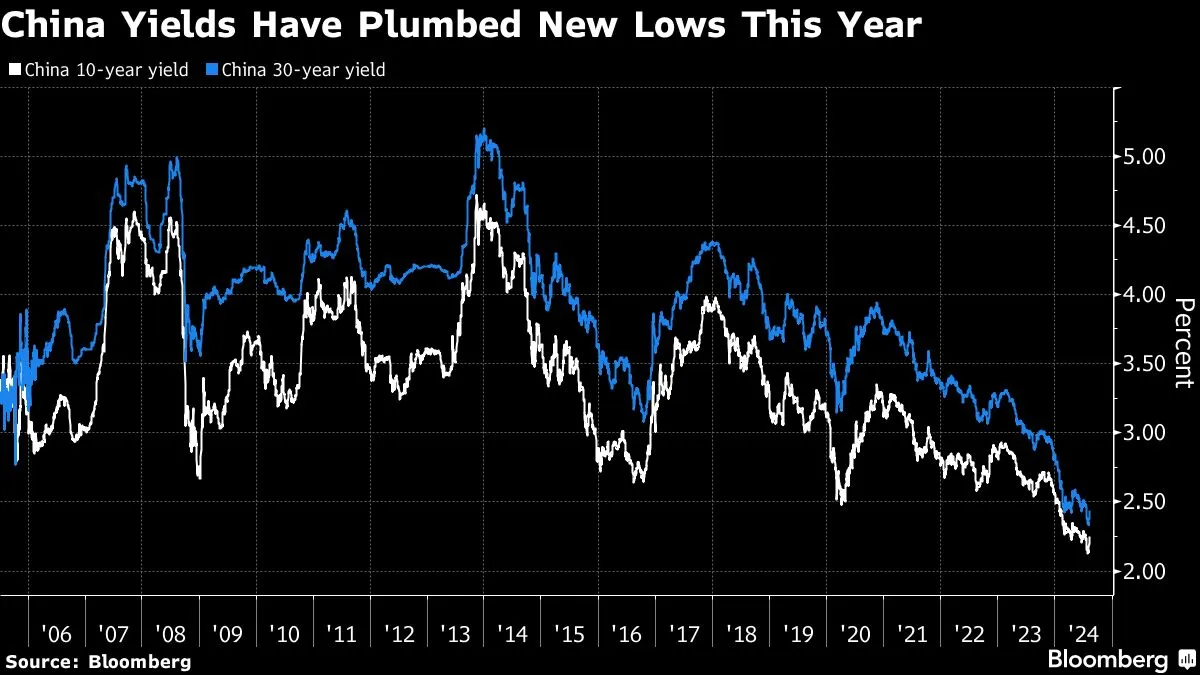

Recently, China has taken significant steps to curb volatility in its bond market. The government has intensified its crackdown on bond trading activities as a response to the growing frenzy among investors.

Current Market Dynamics

- State banks are heavily involved in selling bonds of various maturities.

- Investors are eagerly waiting for potential moves by the People's Bank of China.

Implications for Investors

The actions taken by state banks aim to restore stability, but the lack of a decisive intervention from the central bank raises concerns among market participants.

- This situation reflects ongoing fluctuations within the global bond market.

- Investors must remain vigilant as the situation evolves.

In conclusion, while immediate actions are being taken by state banks, the market is keenly awaiting the central bank's decisions, which could have wide-ranging implications for financial stability.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.