Declining Mortgage Rates: Analysis and Implications for Borrowers

Recent Trends in Mortgage Rates

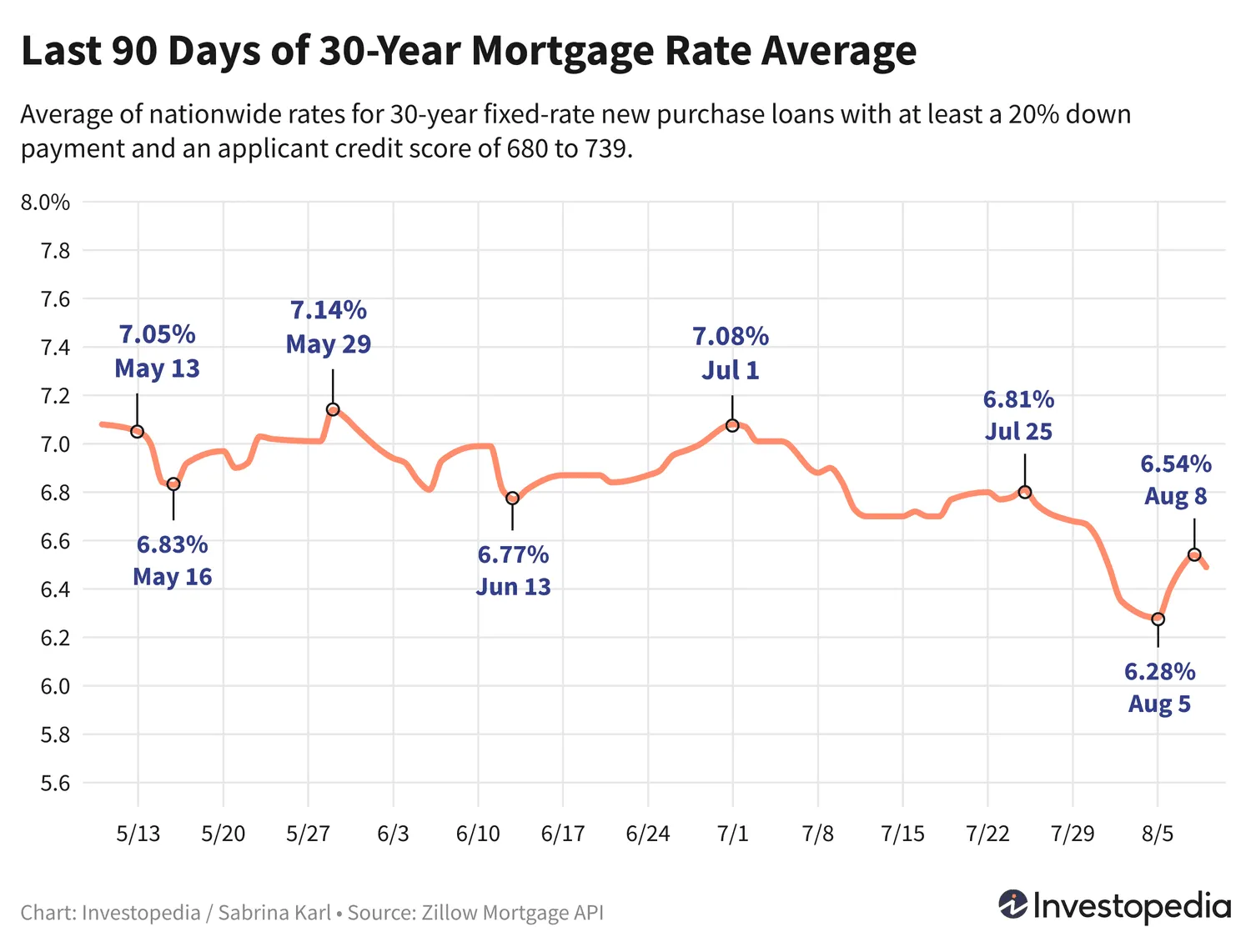

After experiencing a significant plunge, mortgage rates on 30-year loans saw a temporary increase over the past week. However, they ended approximately two-tenths of a point above their recent lows.

Impact of Mortgage Rate Changes

- Current Rates: Rates remain at favorable levels compared to past performances.

- Market Fluctuations: Understanding the trends is essential for potential borrowers.

- Economic Indicators: Keeping track of these will help in making informed decisions.

Conclusion

The recent dip in mortgage rates presents an opportunity for borrowers, despite a modest increase in rates towards the end of last week. Staying updated on market trends and economic indicators will be key to navigating these changes effectively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.