Chinese Brokerages Restrict Bond Trading in Response to PBOC Warnings

Introduction

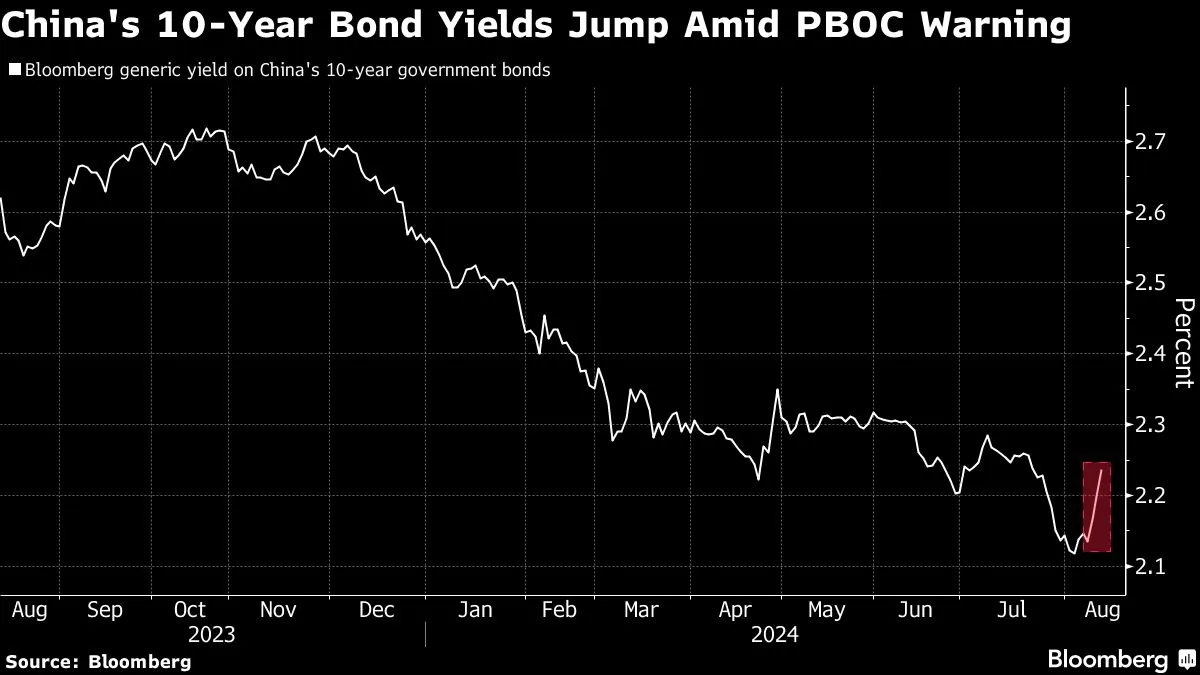

In response to recent warnings from the People's Bank of China (PBOC), Chinese brokerages are enacting measures aimed at curbing the trading of domestic government bonds. This shift has significant implications for investors in the bond market.

Background

- At least four brokerages have initiated restrictions.

- The moves are a reaction to the PBOC's caution regarding market stability.

- Concerns center on the potential for a bond rally impacting financial equilibrium.

Implications for Investors

As these brokerages implement new trading cuts, investors must remain vigilant. The tightening of bond trading could lead to increased market volatility and necessitate a reassessment of investment strategies.

Conclusion

These developments reflect the delicate balance between regulatory oversight and market forces in China's economic landscape. Investors are advised to stay informed as PBOC policies evolve and shape the bond market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.