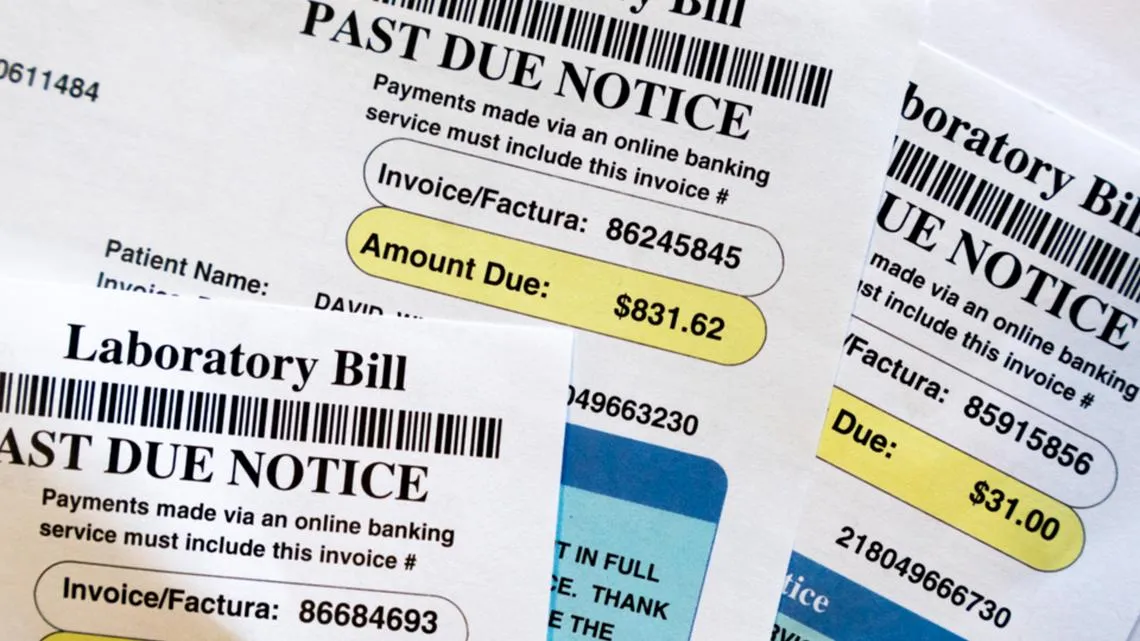

Proven Tips for Relieving Medical Debt Stress

Understanding the Landscape of Medical Debt

According to a 2022 study, 20% of households in the U.S. are burdened by medical debt, leading to financial distress and overwhelming credit report impacts.

Strategies for Managing Medical Bills

1. Review Your Medical Bills

- Carefully check for any errors in billing.

- Ensure that all services received are accurately billed.

2. Negotiate with Providers

Many healthcare providers are open to negotiation. Don’t hesitate to discuss your bill with them.

3. Explore Financial Assistance Programs

- Look for patient assistance programs offered by hospitals.

- Check if you qualify for government aid programs.

Conclusion

Addressing medical debt requires awareness and action. By negotiating, reviewing bills, and applying for assistance, individuals can effectively manage high medical expenses. It’s essential to take these proactive steps to achieve financial relief.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.