Understanding the Relevance of the Dot-Com Bubble in Today's AI Landscape

Understanding the Lessons from the Dot-Com Bubble

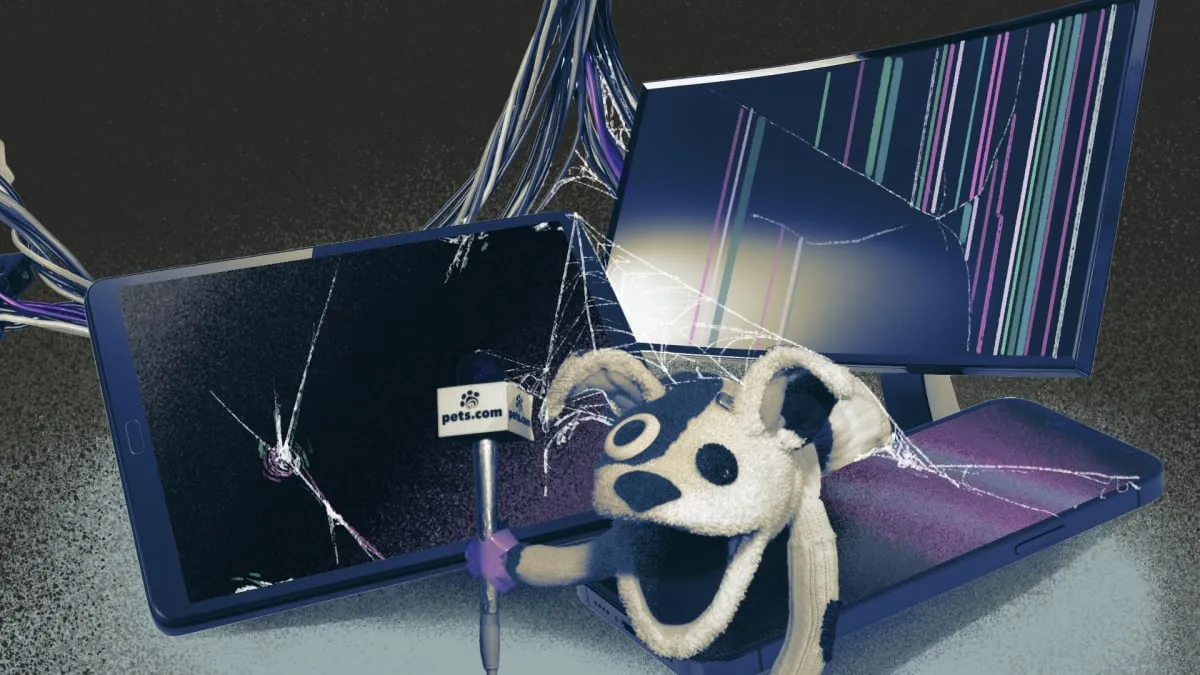

The dot-com bubble, which peaked in the late 1990s, serves as a crucial reference point for today’s fast-paced AI investments. As savvy investors scrutinize the implications of past bubbles, it becomes clear that historical patterns can inform current strategies.

The Cyclical Nature of Financial Crises

- The AI implosion of 2024 echoes sentiments from years prior, making the study of previous bubbles even more pertinent.

- Many of the brightest minds in technology face significant financial challenges reminiscent of the dot-com aftermath.

Key Takeaways

- Understand Market Psychology: Investor behavior often leads to dramatic price hikes followed by sharp declines.

- Diverse Portfolio Management: Strategic diversification can mitigate risks during downturns.

Ultimately, recognizing the historical significance of these events allows for more informed investment decisions. Exploring these past lessons yields valuable insights for current market conditions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.