Exploring Minnesota's Progressive Tax System and Its Influence on Future Tax Policies

Understanding Minnesota's Progressive Tax System

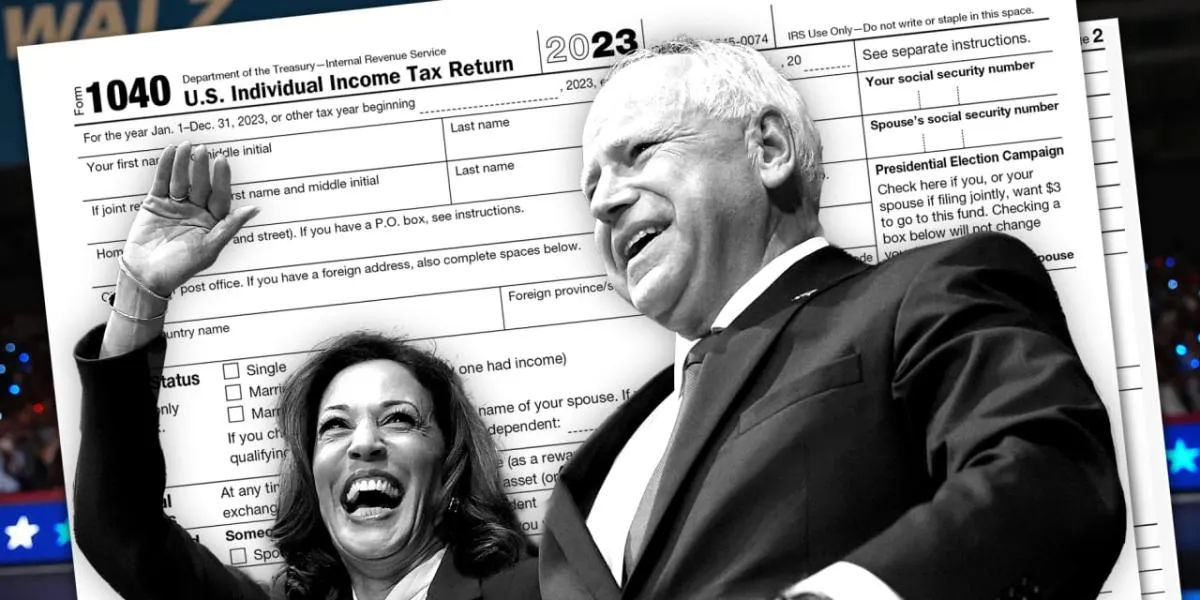

Minnesota has garnered attention for implementing the most progressive tax system in the country. With a notable child tax credit of $1,750 per child, this progressive model represents a substantial shift in state-level tax strategy. Experts believe this could serve as a blueprint for future federal tax policies, particularly regarding Kamala Harris's 2025 proposals.

The Implications for Kamala Harris's 2025 Tax Plans

- Potential adoption of similar state-level credits nationally

- Encouragement of progressive tax policies across various states

- Impact on middle and lower-income families

As we observe the dynamics of tax policy, understanding Minnesota's innovations can illuminate potential directions for federal reforms. The landscape of taxation could be poised for significant change.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.