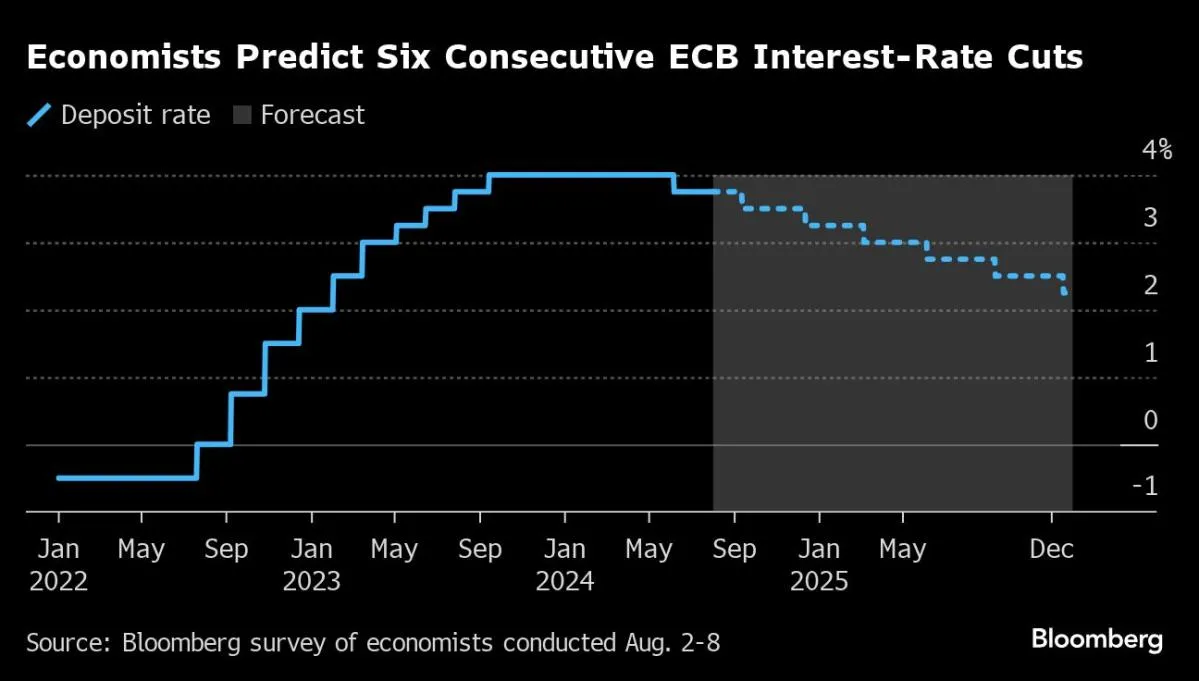

European Central Bank Expected to Decrease Deposit Rate Six Times by 2025

Sunday, 11 August 2024, 21:00

ECB Rate Cut Predictions

The latest survey reveals that the European Central Bank (ECB) is set to reduce its deposit rate once per quarter until the end of 2025.

Implications of Rate Cuts

- Accelerated Easing Cycle: The timeline for easing is quicker than previously expected.

- Support for Economic Recovery: Rate cuts aim to bolster the economy.

- Market Influences: Changes in monetary policy could impact global financial markets significantly.

Conclusion

In summary, the ECB's strategic move to cut interest rates could reverberate through the economy and influence investor sentiment across financial markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.