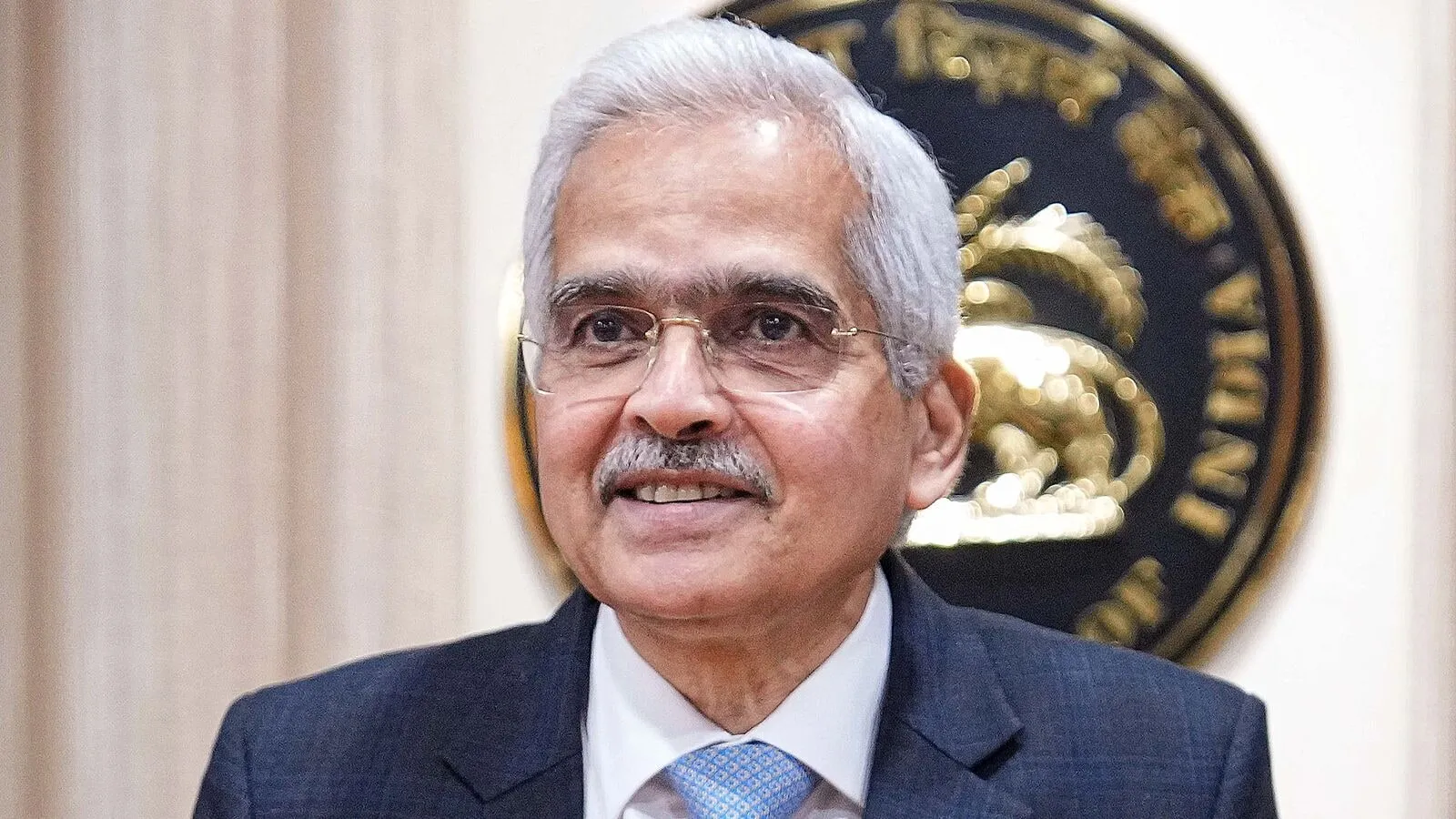

Why RBI Maintains a Non-Neutral Policy Stance

Understanding the RBI's Policy Stance

The Indian central bank, known as the RBI, maintains a strong focus on price stability, even amidst looming risks associated with exchange rate volatility. This approach has raised questions regarding its decision to not yet transition to a ‘neutral’ policy stance.

Reasons Behind RBI's Cautious Approach

- Price Stability Priority: The primary goal of the RBI remains ensuring that inflation is kept in check.

- Global Economic Uncertainty: Ongoing volatility in global markets necessitates a careful and measured approach.

- Mitigating Financial Risks: Shifting towards a neutral stance could expose the economy to potential risks.

Conclusion

In light of these considerations, RBI appears committed to its current policy stance, balancing the complexities of both domestic and global economic landscapes.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.