Trump and Harris Advocate for Eliminating Tip Taxes: A Critical Analysis

Sunday, 11 August 2024, 11:23

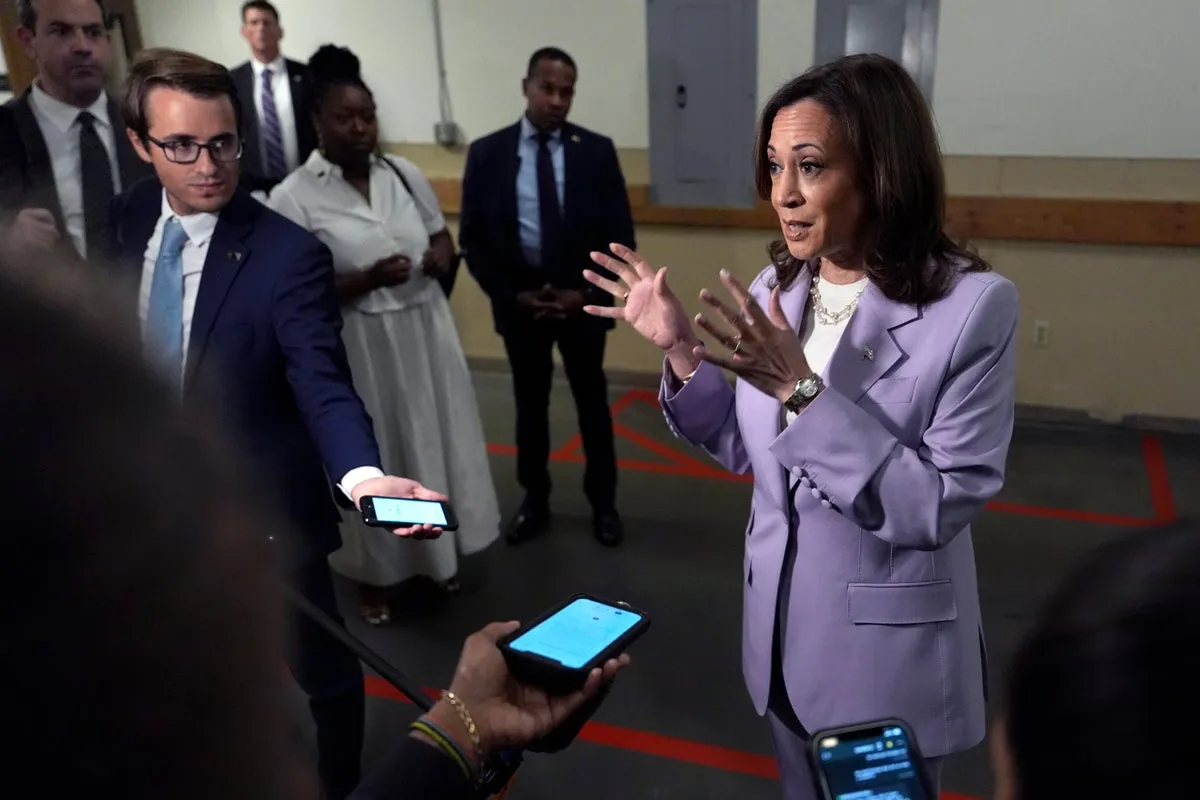

Trump and Harris Propose No Tax on Tips

Both Donald Trump and Kamala Harris are in agreement on the need to eliminate taxes on tips. This policy proposal is designed to support workers in the service industry.

Understanding the Potential Risks

- Revenue Loss: The removal of tip taxes could lead to significant revenue losses for local and state governments.

- Economic Impact: Experts caution that losing a source of tax revenue may lead to unbalanced economic planning.

- Policy Comparison: The proposal has been met with mixed reactions, with some pointing out the potential pitfalls stemming from similar measures.

Conclusion

While eliminating tips taxes may benefit individual workers, it is essential to evaluate the comprehensive economic impact of such a policy change.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.