Record Highs in Global Gold Demand and Prices Reported for Q2 2023

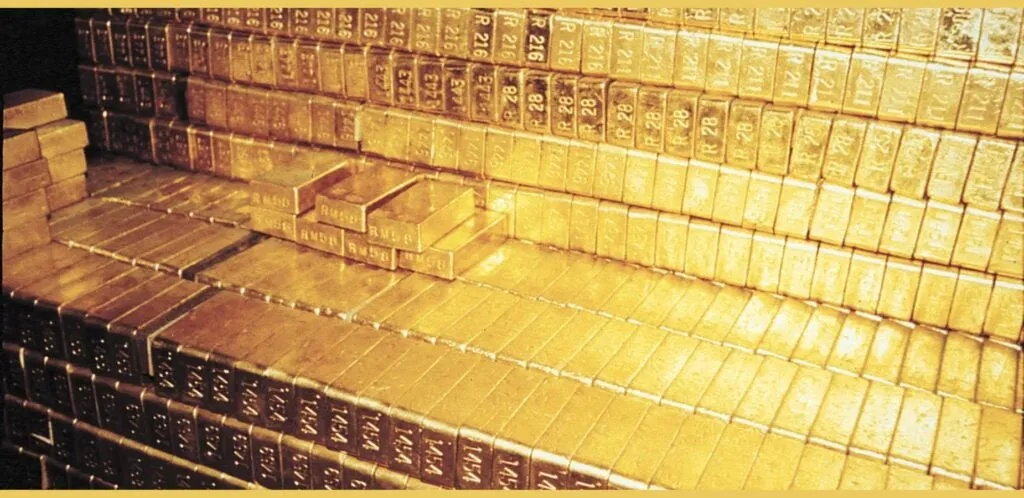

Global Gold Demand Reaches New Heights

The latest report from the World Gold Council illustrates that global gold demand has surged to record levels in the second quarter of 2023. This trend is particularly notable given that there has been a sharp decline in jewelry demand and unprecedented levels of mine production.

Investor Behavior and Market Response

Despite these contradictory market signals, investors are showing strong interest in gold as a safe-haven asset. This has contributed to the current upward pressure on gold prices.

- Record highs in demand have been recorded.

- Jewelry demand has dropped significantly.

- Mine production reached an all-time high.

Conclusion

As inflation and economic uncertainty continue to loom, the strong demand for gold is likely to persist. Investors may increasingly view gold as a protective measure, reinforcing its place in investment portfolios as a valuable asset.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.