Understanding the Hidden Risks Facing AI Stocks Due to Accounting Methods

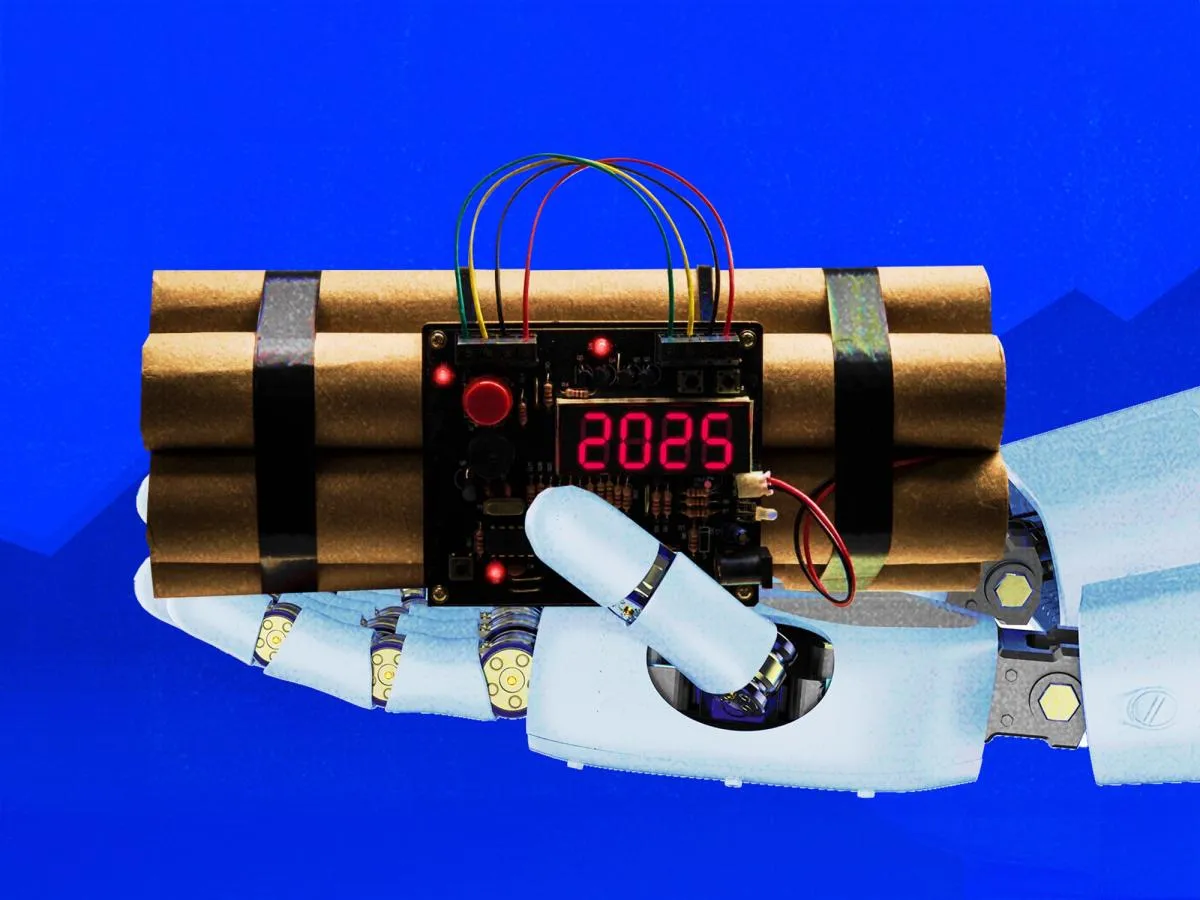

The Hidden Accounting Risks for AI Stocks

An accounting method used to measure the expenses associated with new technology implementation could have significant repercussions for AI companies. Firms that make substantial investments in AI chips may face challenges in managing their financial reporting.

How This Could Affect Firms

- Potential Profitability Issues: Companies might report lower earnings, impacting their market perception.

- Investment Decisions: Investors might reconsider their positions based on altered financial reports.

Conclusion

As AI continues to evolve, firms must closely monitor their accounting methodologies. By understanding the financial implications of their investments, firms can better prepare for and adapt to the potential risks associated with this emerging technology.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.