The Resurgence of Bonds: A New Hedge Strategy for Investors

Sunday, 11 August 2024, 19:00

The Resurgence of Bonds

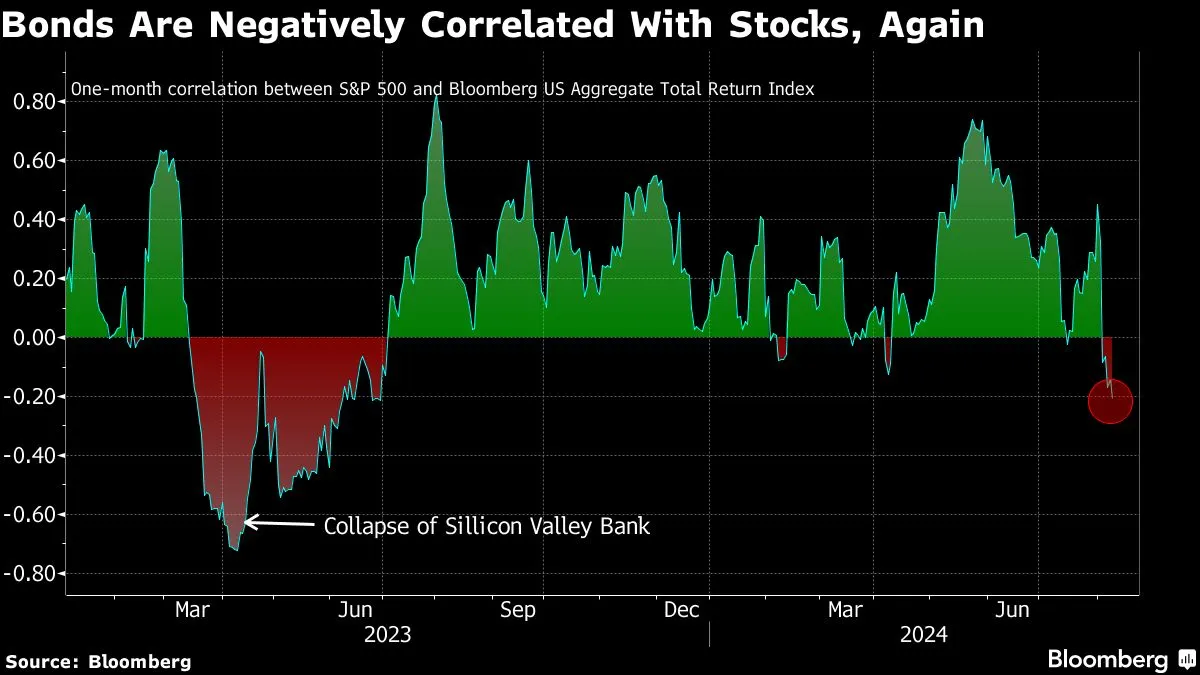

Investors are turning to bonds again, marking a shift in strategy after years of underperformance. Money manager Gregg Abella in New Jersey reports a surge in client interest in adding bonds to their portfolios.

Reasons Behind the Interest

- Market Volatility: Increased concerns about stock market fluctuations.

- Inflation Dynamics: Changing inflation rates leading to reassessed risk.

- Interest Rate Projections: Speculation on future interest rate movements affecting bond yields.

This renewed focus on bonds represents a possible strategic pivot for investors aiming for more stable returns amidst uncertainty.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.