Mortgage Rates Surge: What Homebuyers Should Know

Current Mortgage Rate Trends

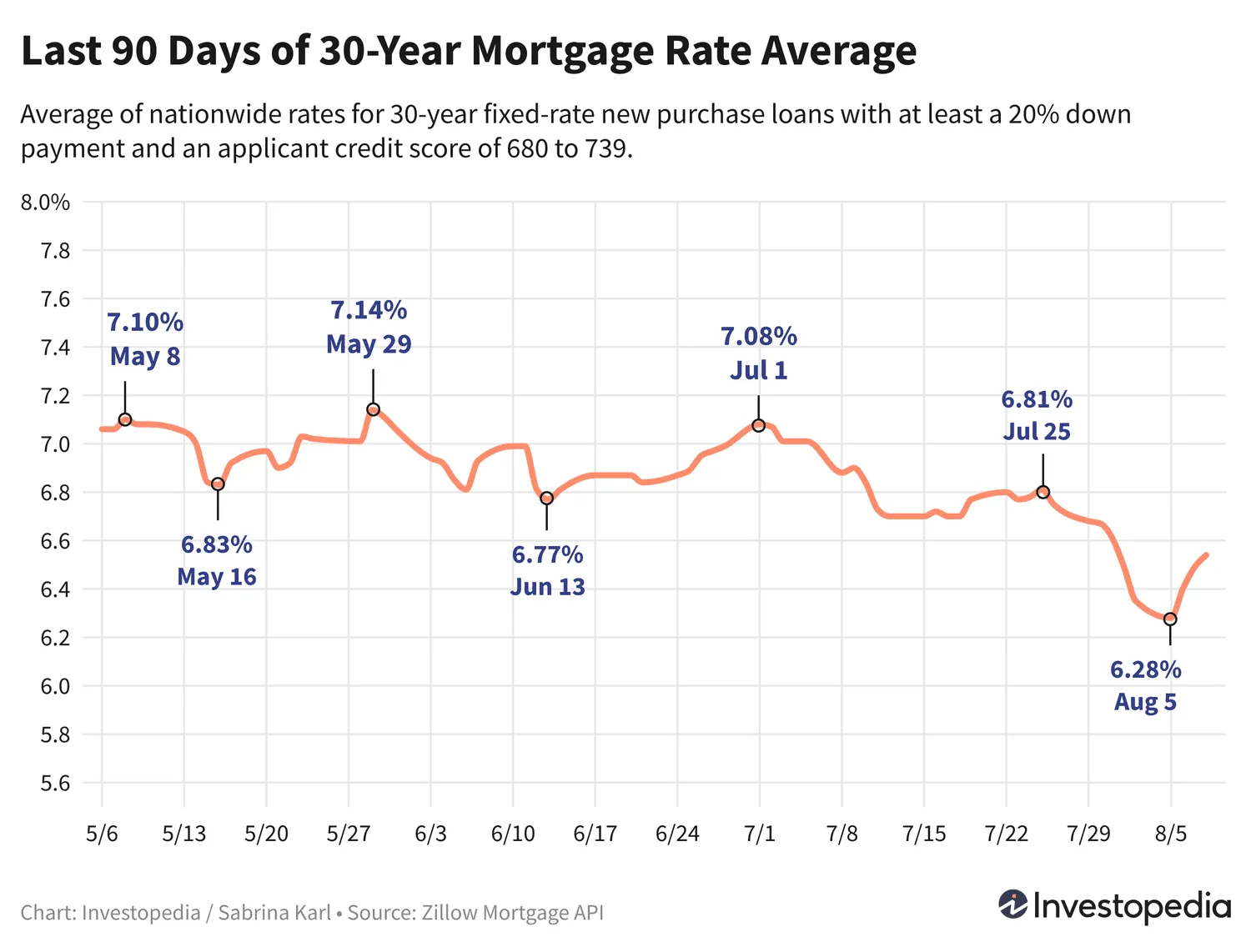

After plummeting on Monday, the 30-year mortgage rate average has risen for the third consecutive day, now standing at 6.54%.

Impact on Loan Types

Most other loan types have also experienced an increase in rates, indicating a trend across the mortgage industry.

What Homebuyers Should Consider

- Increased rates might affect borrowing costs.

- Understanding the fluctuations is essential for planning.

- Staying informed can help in making strategic buying decisions.

As mortgage rates continue to evolve, both potential buyers and the real estate market should prepare for potential impacts on affordability and market activity.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.