Credit Card Debt Reaches Unprecedented Levels, Raising Alarm

Overview of Credit Card Debt

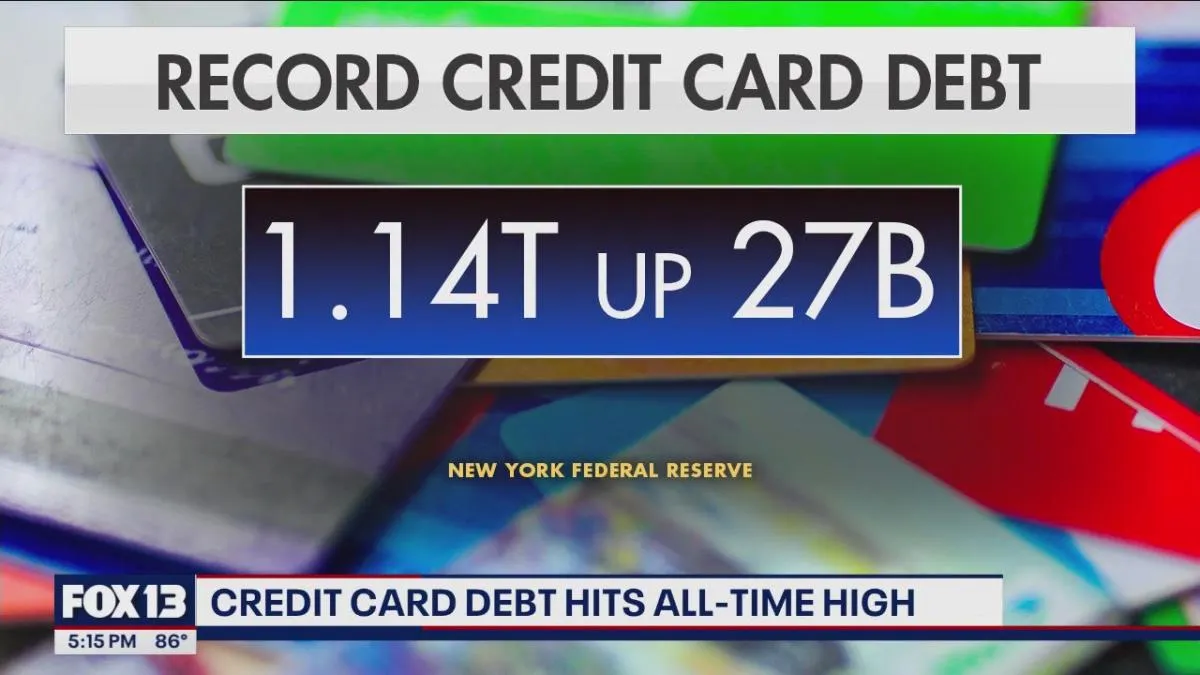

According to a report from the Federal Reserve, credit card debt has hit an all-time high, raising concerns among financial analysts.

Key Insights

- Total credit card debt has reached unprecedented levels.

- A growing number of Americans are missing payments each month.

Implications

The increasing debt levels may lead to significant challenges for consumers, including:

- Higher interest payments

- Reduced consumer spending

- Potential negative impacts on the overall economy

Conclusion

Given the rising credit card debt, it is crucial for consumers to evaluate their financial strategies and seek effective solutions to manage their obligations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.