Why Pensions Might Replace Traditional Investments for Retirees

Understanding Investment Strategies for Retirees

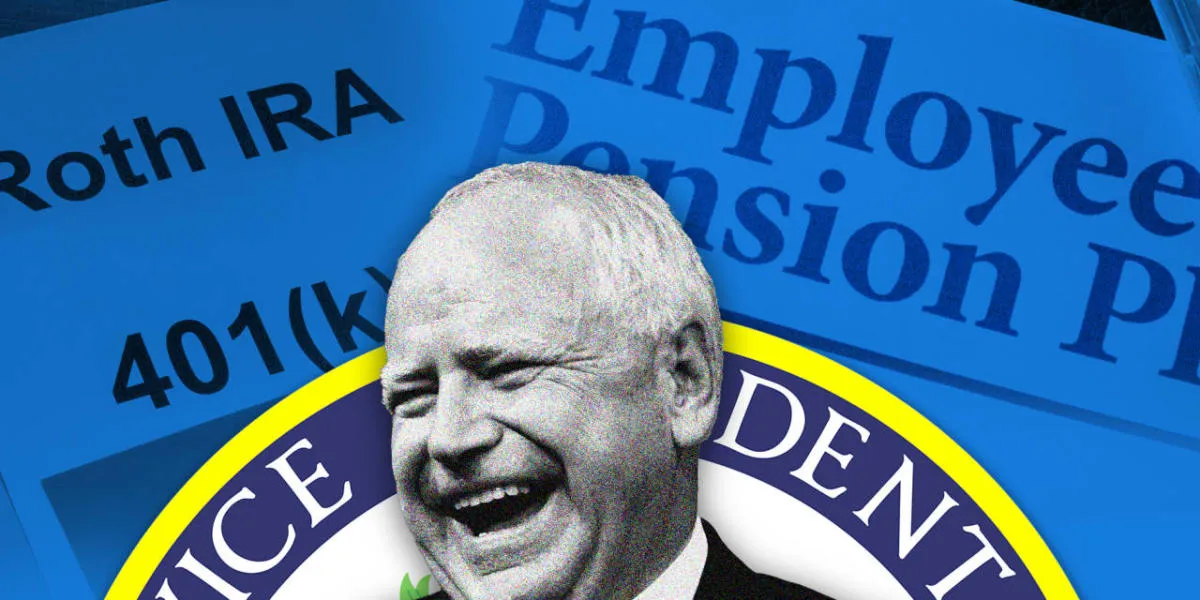

This article explores the unique position of retirees, particularly teachers, who may prioritize pensions over traditional investments like stocks and bonds. While this approach may seem unconventional, it can be a practical decision based on individual financial circumstances.

The Relevance of Pensions

- Pensions provide stable income during retirement.

- Less reliance on volatile markets reduces risk for retirees.

- Personal financial stability should drive investment choices.

Conclusion

In conclusion, Tim Walz and others in similar scenarios should consider their unique situations when evaluating investment strategies. As the financial landscape evolves, the role of pensions could reshape retirement planning.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.