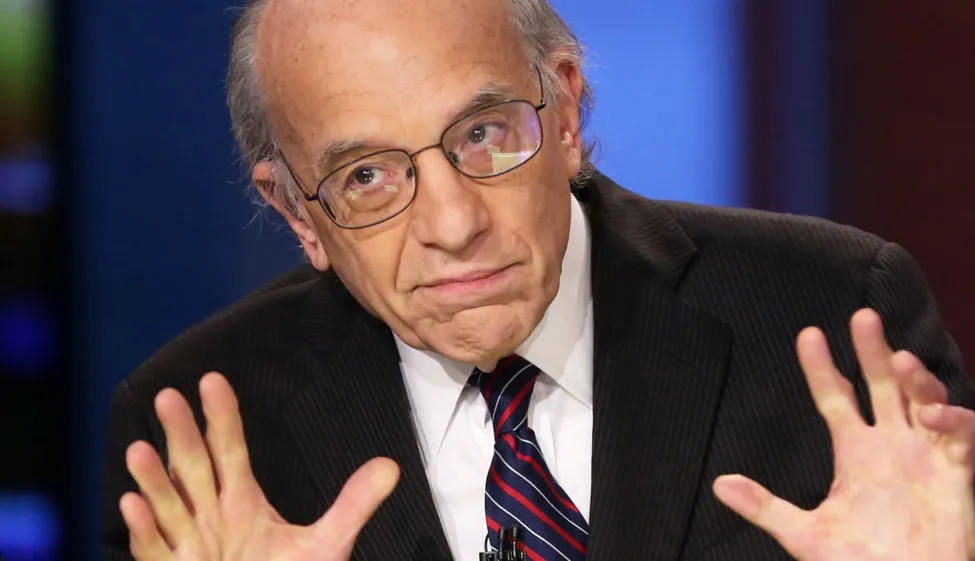

Jeremy Siegel's Shift on Emergency Interest Rate Cuts: What Investors Should Know

Jeremy Siegel on Federal Reserve Rate Cuts

Jeremy Siegel, a prominent economist, has recently reconsidered his stance on calls for an emergency interest rate cut by the Federal Reserve. Initially advocating for a 75 basis point reduction, he is now cautioning that such drastic measures could have negative implications for the economy.

Key Considerations

Siegel emphasizes several crucial points regarding potential rate cuts:

- The risks of inflation becoming more pronounced

- The need for stability in the financial markets

- Encouragement for the Fed to adopt a more measured approach

In conclusion, Siegel's updated view serves as a reminder for investors to remain vigilant regarding Federal Reserve policy changes and their potential impacts on the economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.