Understanding the Initial Data on IRA Tax Credits

Wednesday, 7 August 2024, 09:00

Initial Data on IRA Tax Credits

The recent release of the first data on IRA tax credits has sparked numerous analyses among financial experts. It is crucial to parse this information effectively.

Key Methods of Analysis

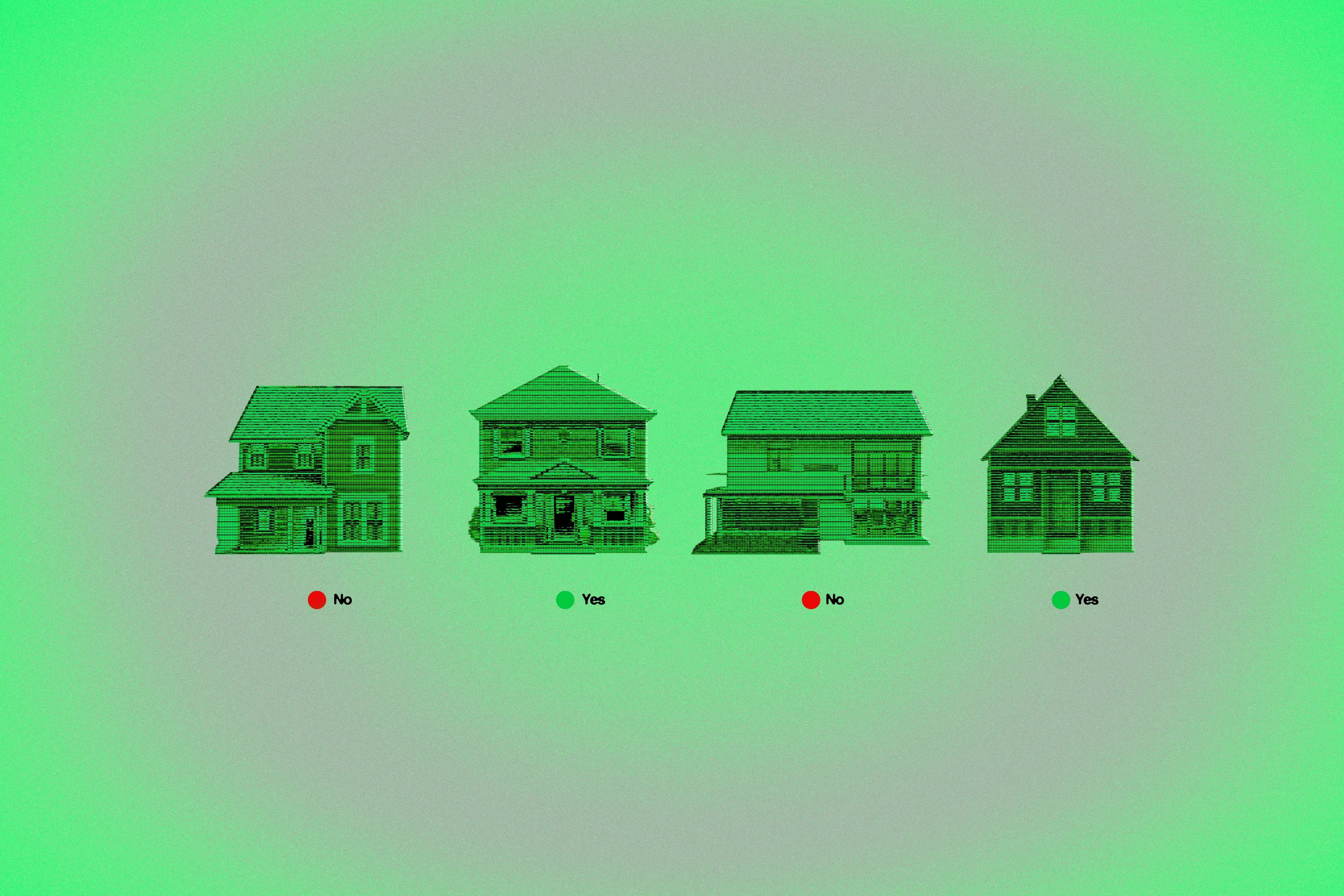

- Demographic Impact: Understanding how different groups are affected.

- Participation Rates: Evaluating how many individuals are utilizing these credits.

- Policy Implications: Assessing what these trends could mean for future legislation.

- Future Predictions: Identifying potential shifts in patterns.

Charts and Data Visualizations

- Chart 1: Participation by Age Group

- Chart 2: State-wise Participation Trends

- Chart 3: Overall Financial Impact

- Chart 4: Future Trends Projection

- Chart 5: Demographic Shifts Over Time

In conclusion, understanding the first IRA tax credit data not only aids individual retirement planning but also informs broader financial policies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.