Banks Adapt to Gen Z Preferences with Buy Now, Pay Later Options

BNPL Solutions Targeting Gen Z

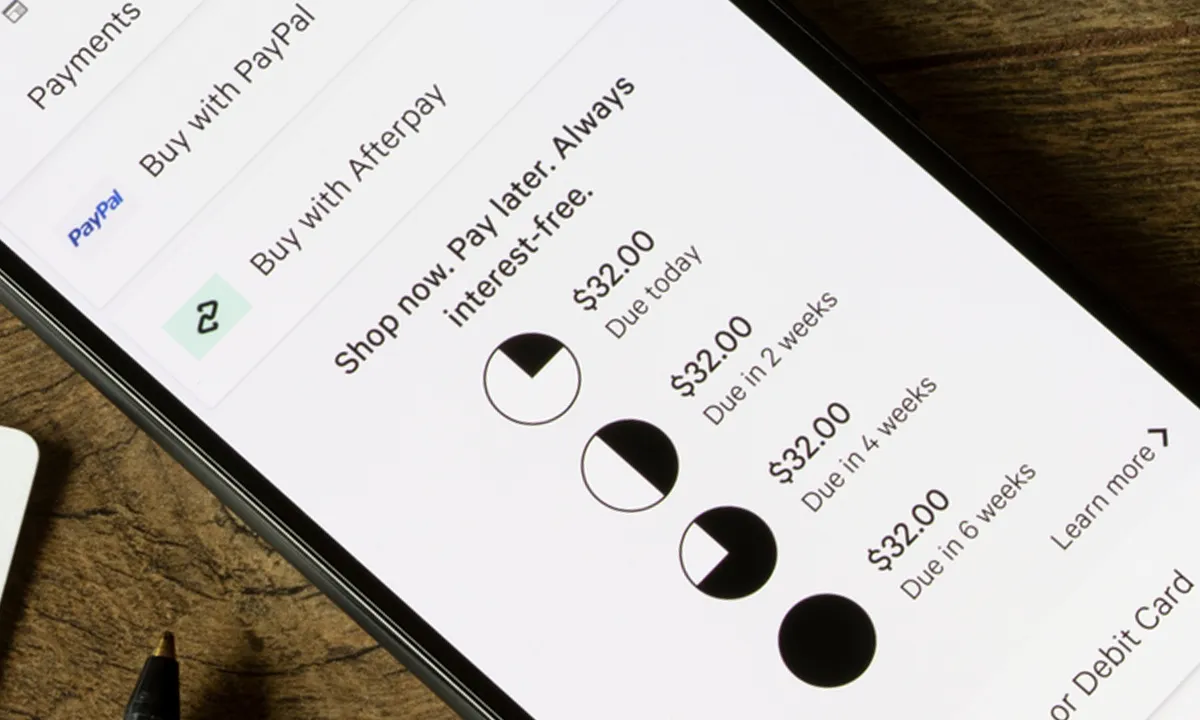

Traditional banks are seeking to capture market share and redefine financial services through Buy Now, Pay Later (BNPL) options. This approach allows young consumers to make purchases and pay for them over time, aligning with their payment preferences.

Key Benefits of BNPL

- Enhancing Customer Loyalty: By offering flexible payment plans, banks can foster stronger relationships with their clients.

- Attracting New Consumers: BNPL solutions appeal to younger generations who prioritize convenience and affordability.

- Adaptation to Market Trends: As BNPL revenues surge, banks recognize the necessity of evolving their services.

In conclusion, integrating BNPL solutions offers a pathway for banks to redefine their service offerings and resonate with a modern, digitally-savvy clientele.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.