Understanding the Differences Between Tim Walz's and Trump's Social Security Tax Approaches

Overview of Tim Walz's Tax Cut

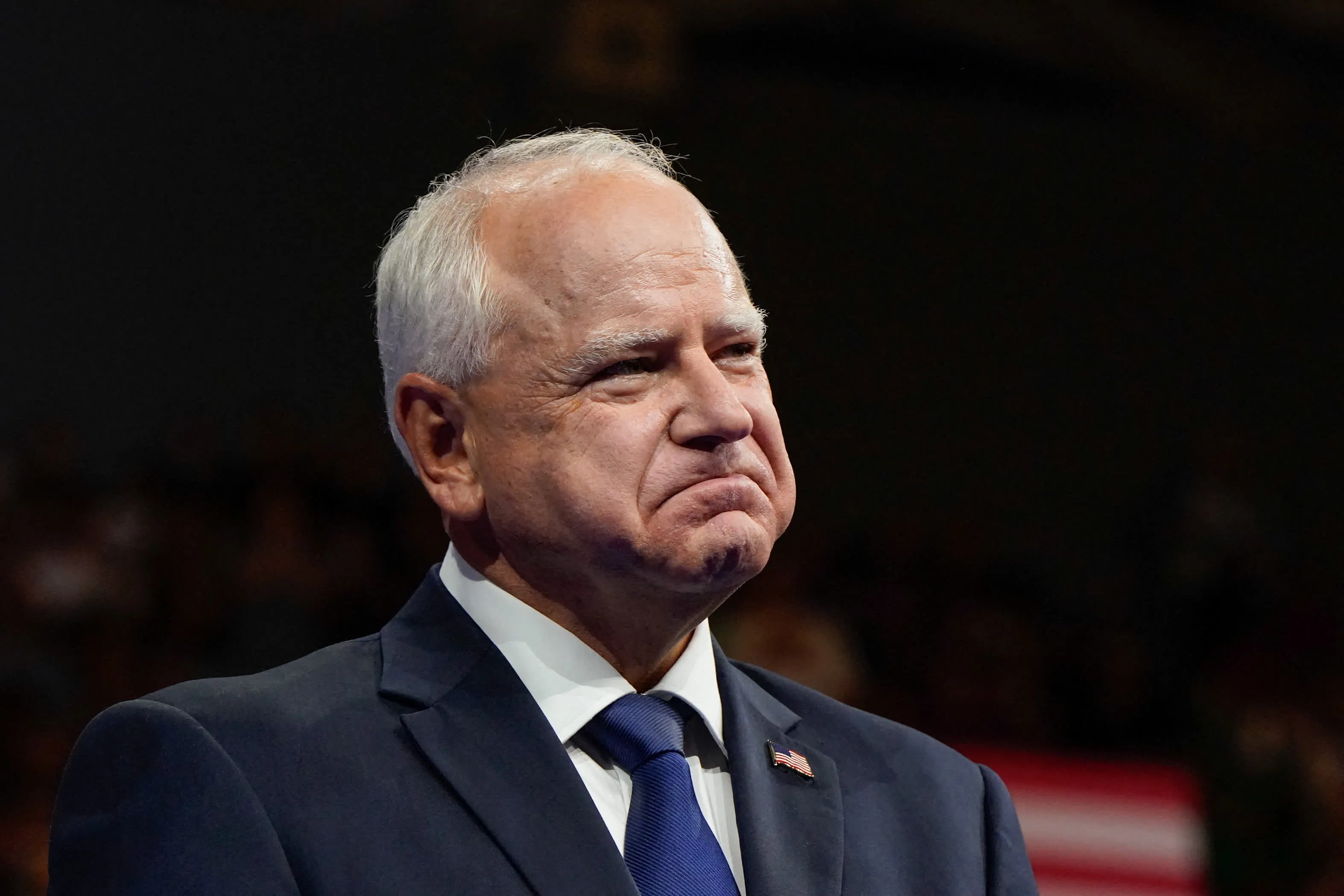

Minnesota Governor Tim Walz has recently introduced a significant tax cut on Social Security income for residents in the state, marking a proactive approach to support retirees.

Comparison with Trump's Proposal

- Walz’s Tax Cut: Focuses on reducing the burden for all seniors within Minnesota.

- Trump’s Plan: Primarily aims at broader tax reforms affecting various income brackets.

Implications for Retirees

The consequences of Walz's decision are expected to provide more immediate relief to Minnesota's elderly population. It highlights a divergence in political strategies concerning fiscal policy and elder care.

- Support for local seniors via direct tax relief.

- Potential political ramifications for both parties as they approach upcoming elections.

In conclusion, while both Walz and Trump seek to address the financial needs of seniors, their approaches reveal underlying differences in fiscal philosophy and targeted support.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.