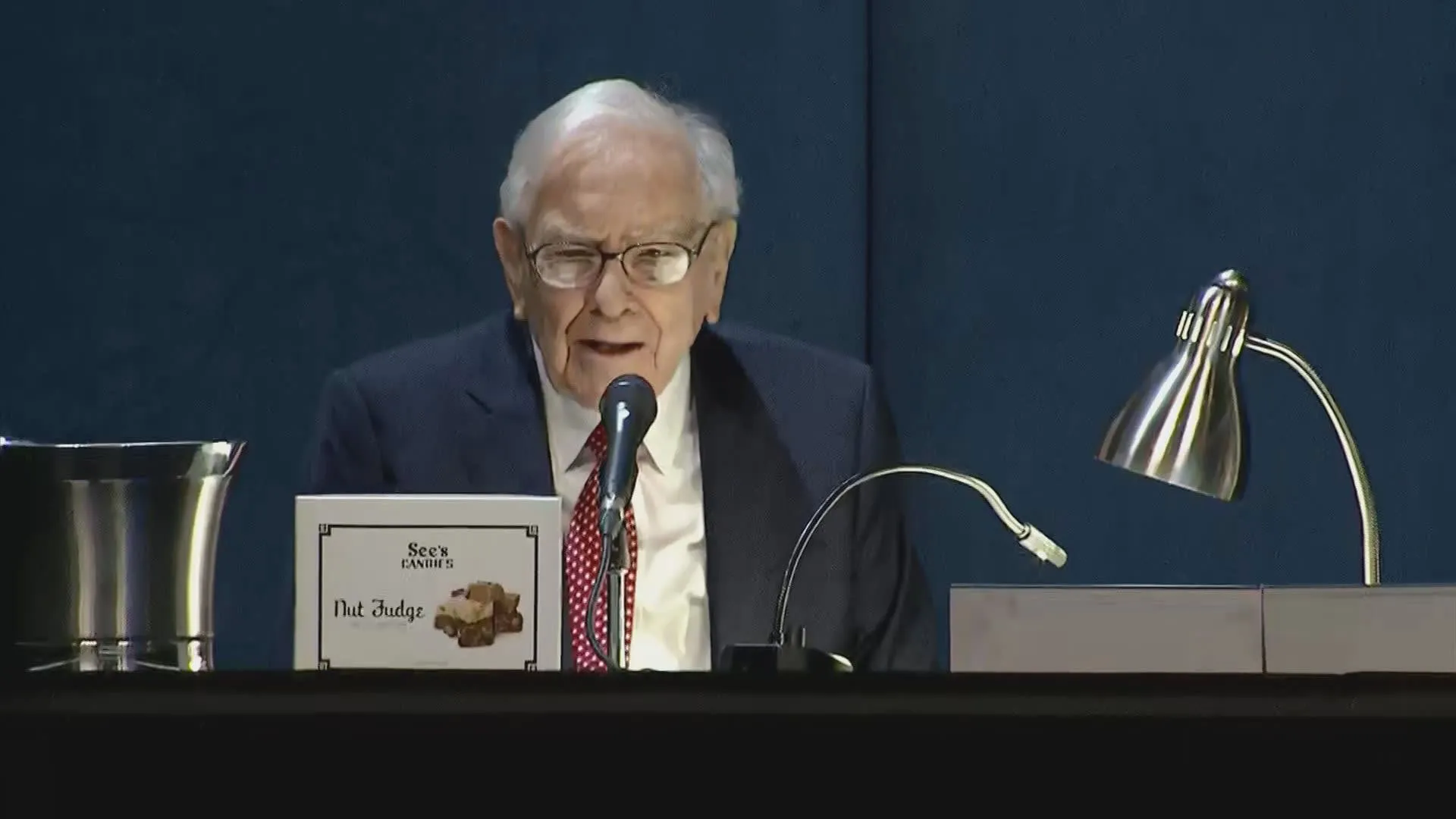

Warren Buffett's Investment Strategy: Treasury Bills Take Center Stage

Warren Buffett's Growing T-bill Holdings

By the end of the second quarter, Warren Buffett's investment vehicle, Berkshire Hathaway, has reported a staggering $234.6 billion in short-term investments in Treasury bills. This significant amount places Berkshire ahead of the Federal Reserve in terms of T-bill ownership, raising eyebrows in the financial community.

Implications of the Investment

- Shift to Safer Assets: Buffett's move underscores a strategic pivot towards safer financial instruments.

- Confidence in U.S. Securities: This could indicate strong confidence in the stability of U.S. government securities amid ongoing economic uncertainty.

- Investment Trends: The trend reflects a larger shift in portfolio management aimed at mitigating risks in volatile markets.

In conclusion, Warren Buffett's robust investment in Treasury bills not only highlights his renowned strategy of value investing but also showcases an essential trend in risk management within the financial markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.