Why Berkshire Hathaway's Apple Stake Cut Shouldn't Alarm Investors

Berkshire Hathaway’s Recent Move

Warren Buffett's conglomerate, Berkshire Hathaway (NYSE:BRK.B), has made headlines with its decision to halve its stake in Apple (AAPL) during the latest quarterly earnings report. This news might have puzzled some stakeholders.

Investor Reactions

Many investors were caught off guard by this disclosure; however, it's essential to consider the broader context.

- Berkshire Hathaway is sitting on an impressive cash reserve.

- The reduction in the Apple stake could be a part of a larger strategy.

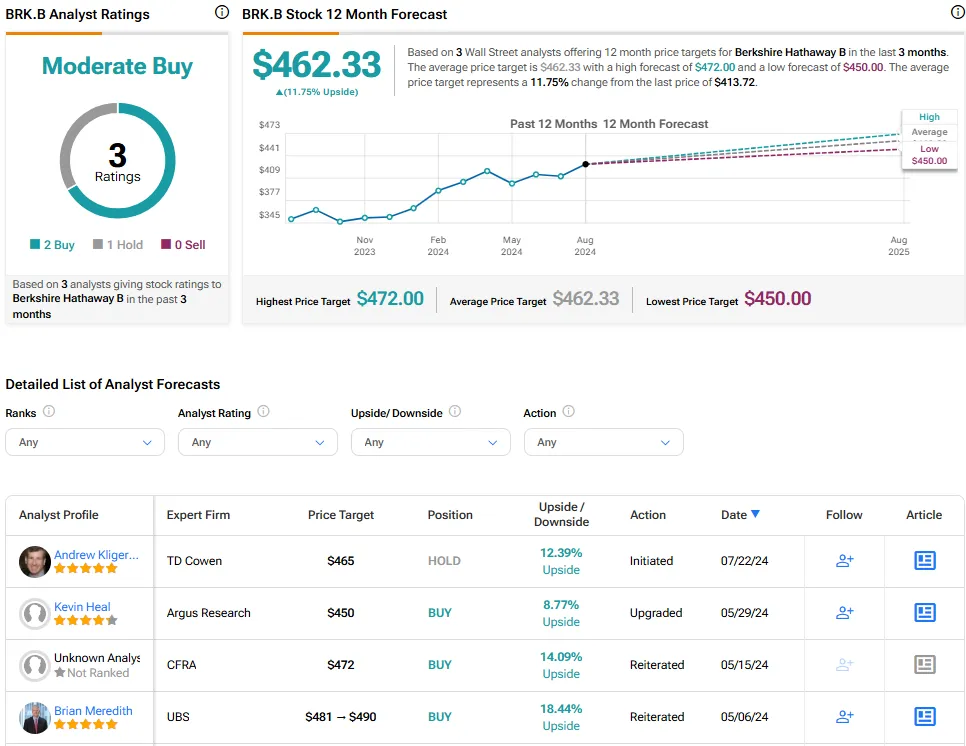

- Analysts maintain a bullish outlook on Berkshire Hathaway despite recent changes.

Conclusion

In summary, while the halving of the Apple stake raises questions, it also underscores Buffett's cautious and strategic approach to investment. Investors should remain focused on the long-term prospects of Berkshire Hathaway, which seems well-positioned for future growth.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.