Bitcoin's Recovery: Analysis of the Recent Sell-Off and Market Trends

Understanding Bitcoin's Recent Fluctuations

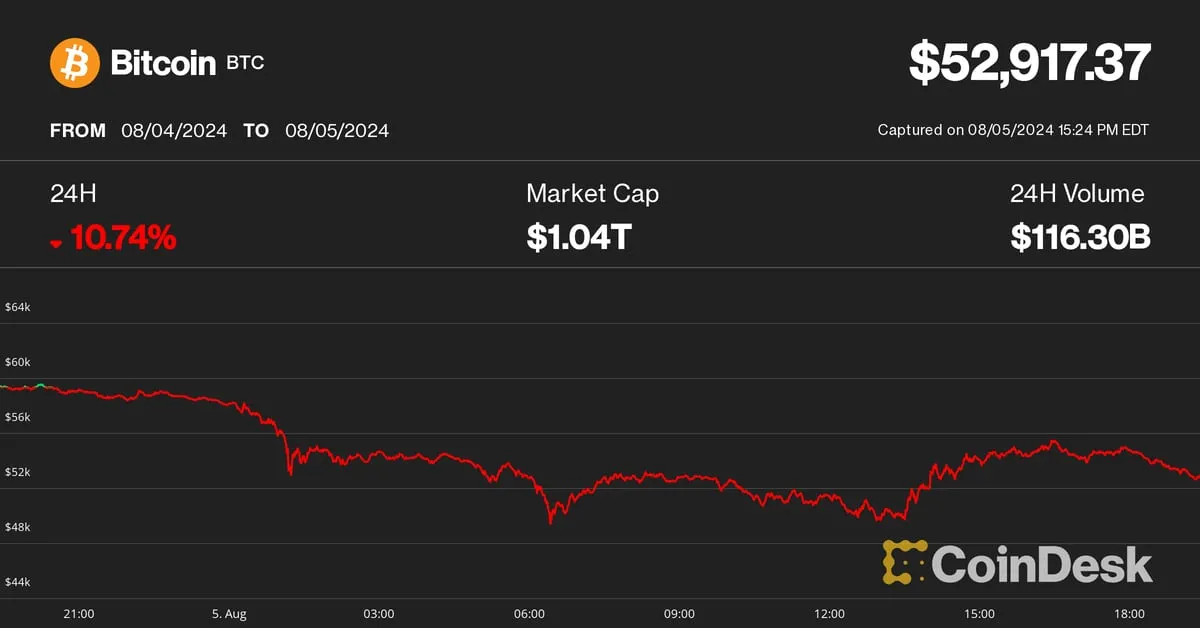

Bitcoin's recent decline of 30% in just one week has sparked comparisons to the brutal March 2020 crash. Observers have noted that such significant drawdowns can occur during bull markets, presenting both risks and opportunities for investors.

Market Resilience

- The cryptocurrency market has shown a high degree of resilience.

- Bitcoin quickly rebounded to $53K after the initial downturn.

- Investors should analyze historical trends to navigate current market conditions.

Conclusion

In light of this recent sell-off, it’s essential for investors to remain informed about market movements. While volatility is a hallmark of the cryptocurrency landscape, the bounce back to $53K suggests potential growth moving forward.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.