Impact of Berkshire Hathaway's Stake Reduction on Apple Supplier Stocks

Impact of Berkshire Hathaway's Decision

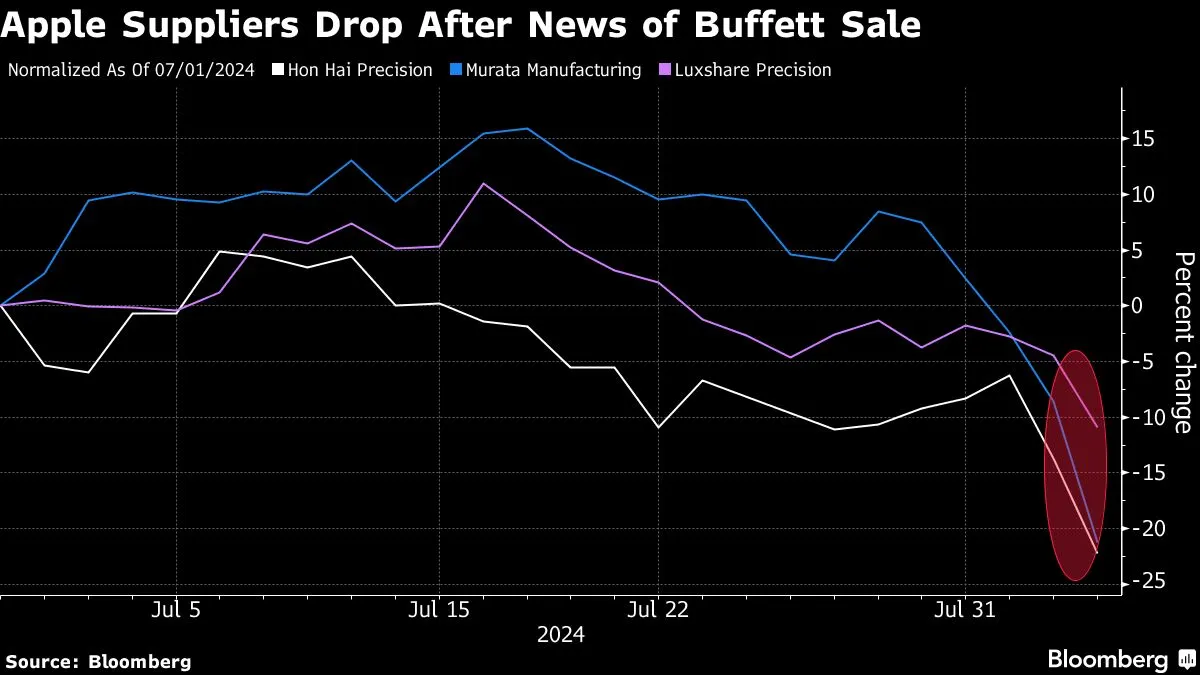

Shares of Apple Inc.'s suppliers faced significant declines after Berkshire Hathaway Inc. made the decision to nearly halve its stake in the tech giant. This decision had repercussions not only for the suppliers but also for the broader market, resulting in a widespread selloff observed on Monday.

The Broader Market Perspective

This decline underscores the sensitivity of supplier stocks to actions taken by major shareholders like Berkshire Hathaway. The effects of such actions can ripple through the financial landscape, especially within the tech sector where Apple holds substantial influence.

- Berkshire Hathaway's reduced stake has caused supplier stocks to slump.

- A broad market selloff was also observed on the same day.

- The incident highlights the interconnectedness of big tech and its suppliers.

In conclusion, Berkshire Hathaway's stake adjustment demonstrates how significant shareholder decisions can impact associated industries and market perceptions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.