The Implications of the IRS Direct File Tax Preparation Program

Introduction

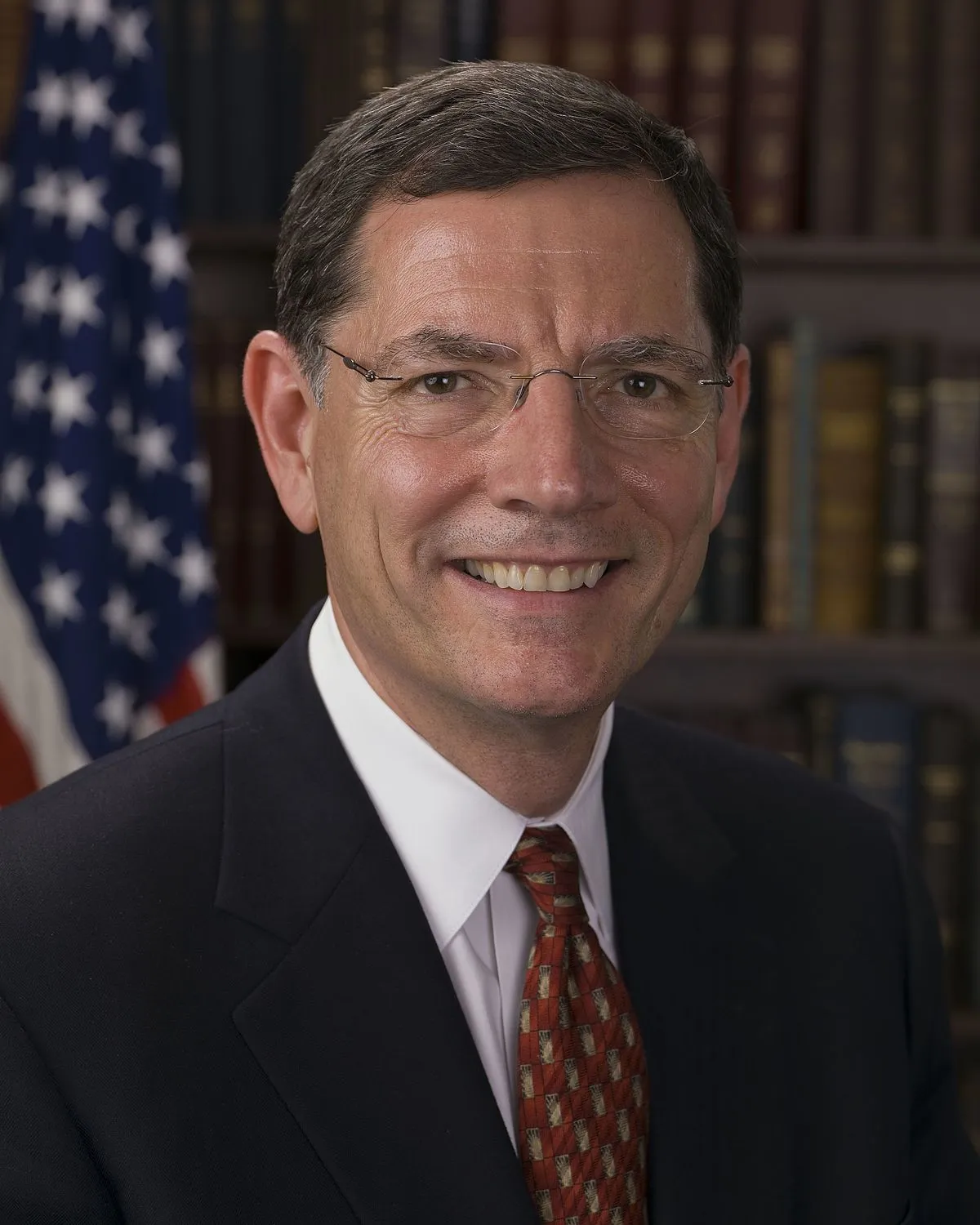

Senators Barrasso and Crapo have expressed serious concerns regarding the IRS Direct File tax preparation program. Their recent letter highlights this initiative as a potential power grab by the agency.

Key Concerns

- Overreach of Power: The senators argue that this program could lead to excessive government control over tax preparation.

- Taxpayer Rights: There are fears about compromising the rights and privacy of taxpayers.

- Need for Transparency: They stress that any implementation of such programs must prioritize clear communication and accountability.

Conclusion

The letter from Senators Barrasso and Crapo serves as a crucial reminder of the potential implications of expanding government roles in personal finance. As discussions around the IRS Direct File program continue, it is essential to consider the balance between aiding taxpayers and preserving individual rights.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.