Stanley Druckenmiller Takes a Risky Bet on Small Caps Amidst Selling Nvidia

Thursday, 16 May 2024, 10:46

Bold Bet on Small Caps

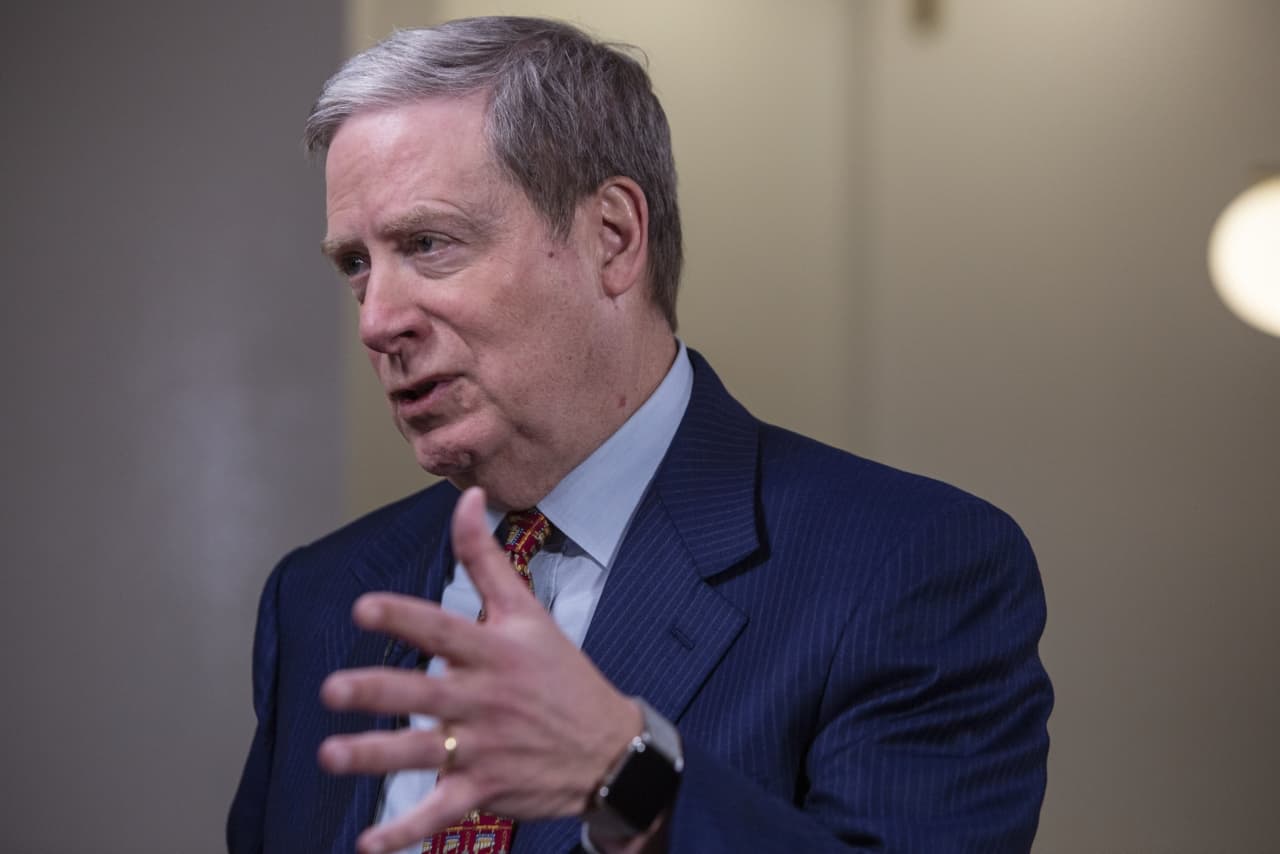

Stanley Druckenmiller, renowned investor and founder of Duquesne Family Office, made a surprising move by shifting towards small caps in a bullish stance.

Risky Decision

Druckenmiller recently opted for this unloved asset class in a strategic pivot, while concurrently divesting Nvidia shares, raising eyebrows in the financial community.

- Unloved Assets: Despite being in an unpopular category, small caps have become the focal point of Druckenmiller's latest investment strategy.

- Market Reaction: The market is closely watching the performance of these small cap stocks amidst Druckenmiller's unconventional move.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.