Is Celestica Stock a Smart Buy After Recent Price Decline?

Celestica (CLS) Stock Overview

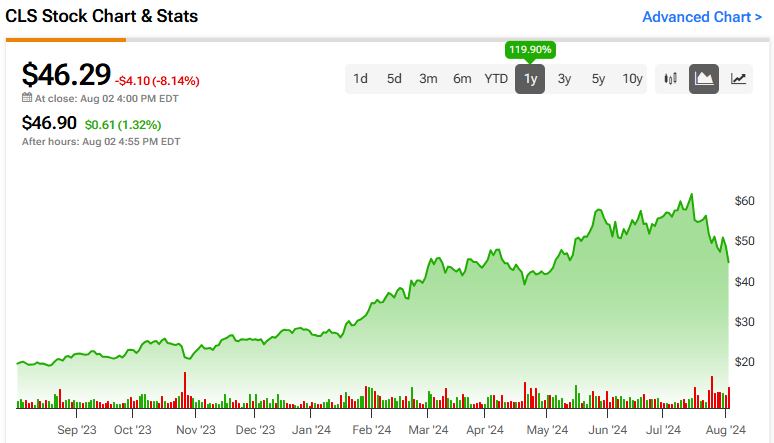

Celestica (CLS) has seen a sharp decline in its stock price from its previous peak, signaling potential investment opportunities for savvy investors.

Recent Performance

- The stock reached a 52-week high of $63.49, now trading significantly lower.

- Strong growth in the AI sector contributed to previous surges.

- Current P/E ratio is below the five-year average.

Investment Outlook

Given these factors, Celestica appears to be undervalued, making it a possible addition to investment portfolios.

- Evaluate the stock based on long-term growth prospects.

- Consider the overall market trends and AI sector performance.

- Analyze the risk versus reward before making a decision.

In conclusion, while market fluctuations raise concerns, Celestica's current pricing offers a potential buying opportunity for investors looking to capitalize on its undervaluation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.