Snap Inc. Q2 2024 Earnings Review: Mixed Results and Market Impact

Key Takeaways from Snap Inc.'s Q2 2024 Performance

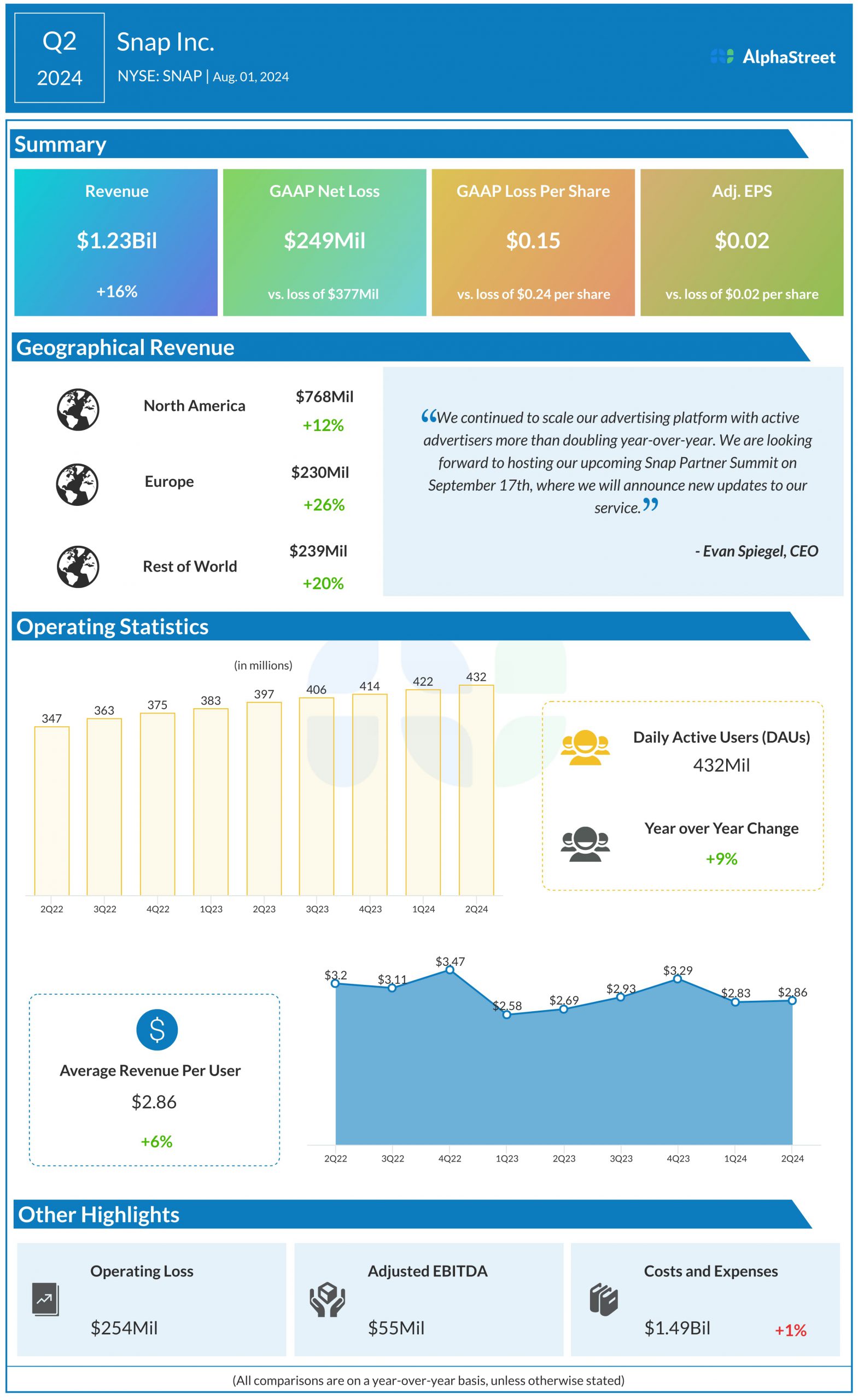

Shares of Snap Inc. (NYSE: SNAP) plummeted 26% on Friday after the company delivered mixed results for the second quarter of 2024. The earnings report revealed revenue of $1.24 billion for Q2 2024, but the guidance for Q3 did not impress Wall Street.

Quarterly Numbers

- Revenue: $1.24 billion in Q2 2024

- Investor sentiment declines sharply

- Concerns over advertiser spending and future growth

Conclusion

Snap's mixed earnings and disappointing guidance have raised questions about its ability to navigate current market challenges. As tech companies face similar hurdles, the outlook for Snap adds to the uncertainty in the digital advertising sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.